|

• Sales revenues at 391.3 million Euro, up 15.1% on the previous year (+5.2% at constant exchange rate)

• EBITDA up 2.1% to 53.1 million Euro compared to the first nine months of 2014 (+4.1% at constant exchange rate)

• Net profit at 30.4 million Euro, up 18.5% from 25.7 million Euro in the first nine months of 2014

• Consolidated net financial debt at 54.8 million Euro, from 81.7 million Euro at 30 September 2014

• The third quarter shows an improvement in the main economic indicators: Revenues +15.3% YoY to 133.8 million Euro and EBITDA +5.0% YoY to 18.8 million Euro

Bologna, 5th November 2015 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the Quarterly Financial Report at 30th September 2015.

The results for the first nine months of the year, which closed with an increase in net profit of 18.5% to 30.4 million Euro, confirm the positive trend of the previous quarters. Growth in revenues for all the main divisions continued on a quarterly basis, with a substantial improvement in the Retail and T&L segments, mainly in North America and Asia. The Group also showed an improvement in EBITDA, despite the high levels of investment in research and development and in the distribution network.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: “We posted growth at revenue and operating profit level again in the third quarter. In particular, the launch of increasingly innovative products and the strength of the solutions proposed to the market have led to significant growth in our sales in key regions such as North America and Asia, a clear sign of the effectiveness of the investments and strategic decisions made in these areas. It’s worth highlighting the recovery in the quarter of the Industrial Automation division's operating profitability, on the back of the positive trend in the T&L segment in North America. We are pleased with these results, which confirm the quality of our products and the talent of our staff, enabling us to strengthen our competitive position”.

Note that the income statement for the period ending 30 September 2014 was restated to make it comparable to 2015 figures.

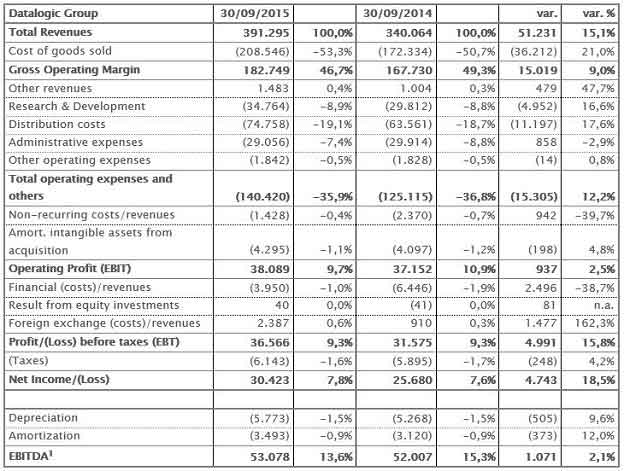

Sales revenues came in at 391.3 million Euro, an increase of 15.1% from 340.1 million Euro in the first nine months of 2014 (+5.2% at constant exchange rates). Bookings reached 405.2 million Euro, up 16.3% compared to the same period of 2014.

New products accounted for 27.7% of revenues in the quarter, continuing the positive trend of the second quarter (26.4%) and confirming the success of technological innovation.

The gross operating margin was 182.7 million Euro, an increase of 9.0% from 167.7 million of the previous year (+3.6% at constant exchange rates).

Operating costs rose by 12.2% to 140.4 million Euro (the increase would have been 3.6% at constant exchange rates), from 125.1 million Euro in the first nine months of 2014. These costs were 35.9% as a percentage of revenues, lower than the figure of 36.8% for the same period of 2014. This performance reflects measures to cut administrative costs in order to boost spending on research and development, the real lever for sustainable growth, which rose from 29.8 million Euro to 34.8 million Euro (+16.6% YoY). Distribution costs were 74.8 million Euro, and rose as a percentage of revenues from 18.7% to 19.1%, mainly owing to the strengthening of the distribution structure.

The EBITDA grew by 2.1% to 53.1 million Euro, from 52.0 million Euro in the first nine months of 2014 (+4.1% at constant exchange rates), chiefly thanks to growth in the third quarter (+5% YoY). The EBITDA margin was 13.6%, compared to 15.3% in the first nine months of 2014; the fall in profitability is mainly attributable to the exchange rate effect, stripping out which the EBITDA margin would have been 15.1%. Also worthy of note are the recovery in Industrial Automation, the continued high profitability of the ADC division and the results of the efficiency projects under way targeting product operating costs.

Operating result grew by 2.5% to 38.1 million Euro, from 37.1 million Euro (+9.4% at constant exchange rates).

After financial charges of 3.9 million Euro - down sharply from 6.5 million Euro in the first nine months of 2014 thanks to the signing in February of a new financing contract with a pool of banks - and exchange rate gains of 2.4 million Euro compared to gains of 0.9 million Euro in the first nine months of 2014, Group net profit came in at 30.4 million Euro, an increase of 18.5% compared to 25.7 million Euro in the same period of 2014.

Net financial debt at 30 September 2015 was 54.8 million Euro, compared to 55.7 million Euro at 31 December 2014, and 81.7 million Euro at 30 September 2014.

Net working capital stood at 32.0 million Euro at 30 September 2015, down from the figure of 37.3 million Euro at 30 September 2014.

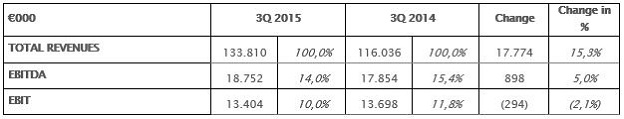

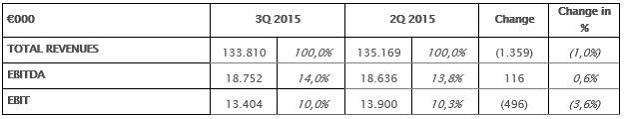

QUARTERLY TREND

Sales revenues in the third quarter of 2015 were 133.8 million Euro, an increase of 15.3% compared to the third quarter of 2014 (at constant exchange rates, revenues would have been 122.7 million Euro, +5.8%), but down 1% compared to the second quarter of 2015 owing to seasonal factors. Bookings in the quarter – orders already received – were 133.6 million Euro, an increase of 14.9% compared to the third quarter of 2014. EBITDA increased to 18.8 million Euro in the quarter, up 5.0% (+8.9% at constant exchange rates), while a rise in non-recurring costs had a negative impact on operating profit.

Comparison between third quarter 2015 and third quarter 2014

Comparison between third quarter 2015 and second quarter 2015

PERFORMANCE BY DIVISION

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, registered revenues of 267.7 million Euro, an increase of 18.2% from the first nine months of 2014. This improvement was also significant at constant exchange rates (+8.3%), thanks to the launch of important in-counter scanners and handheld readers projects in the Retail sector, both in Europe and North America. In particular, North America registered a revenues increase of 12.5% at constant exchange rate in the third quarter 2015 compared to the third quarter 2014.

EBITDA grew by 15.4% to 53.4 million Euro, with a margin substantially unchanged at 20%.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, recorded sales revenues of 103.4 million Euro, up 8.7% from the first nine months of 2014 (1.2% at constant exchange rates). Net of the results of the Business Unit Systems, the division's revenues increased by 13% to 94 million Euro (+6.1% at constant exchange rates), thanks to the introduction of new products and solutions in the T&L sector. Specifically, the third quarter registered an increase in revenues of 9.2% at constant exchange rates compared to 2014, with revenues up 20.8% at constant exchange rates in North America. Net of the results of the BU Systems, the EBITDA margin was 9.0%. The division's operating profitability was affected by higher research and development costs, which rose from 11.4% to 12% as a percentage of revenues, and in the distribution network mainly in the US, which rose from 26.7% to 29.1% as a percentage of revenues.

Finally, Informatics posted revenues of 22.1 million Euro, compared to 19.7 million Euro in the first nine months of 2014 (+11.7%).

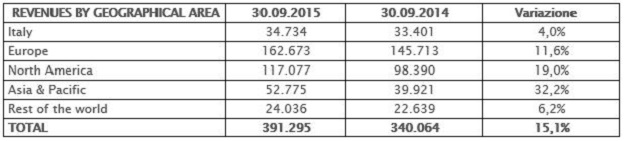

PERFORMANCE BY GEOGRAPHICAL AREA

With regard to geographical areas, the European market posted a very positive performance in the first nine months of the year, with growth of 11.6%, to 162.7 million Euro. The Group registered significant growth in sales in the emerging markets of Asia Pacific, where sales increased by 32.2% (+17% at constant exchange rates) to 52.8 million Euro. The North American market saw a significant recovery in the third quarter for the ADC and Industrial Automation divisions, whose revenues grew by 12.5% and 20.8% respectively at constant exchange rates.

PERIOD EVENTS

On 7 August, Pietro Todescato was appointed as the new Chief Executive Officer of Datalogic ADC, following the resignation of Bill Parnell.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

The results of the first nine months confirm the positive trend of the Group on all key markets. This growth is evidence of the market's high regard for our products and technological solutions, on the back of intense research and development activity and our listening carefully to the needs of our customers.

Also given the positive trend in bookings in the first nine months, we expect the positive performance to continue on all markets in which the Group is present. In particular, the Industrial Automation division will benefit from the revenues generated by projects in the T&L and Postal segments. The ADC division will continue to convert the orders acquired particularly in the Retail segment.

Significant investment in research and development, already equal to 9% as a percentage of revenues, is set to continue; innovation is confirmed as a key pillar in the future of Datalogic, as seen by growth in revenues generated by new products.

***

In today's meeting, the Board of Directors also resolved to adopt the Italian Stock Exchange Code of Self-discipline as updated in July 2015.

Please note that the Interim Management Statement at 30th September 2015 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports – Sergio Borgheresi – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th September 2015 – Euro/1.000

1EBITDA - Earnings before interest, taxes, depreciation and amortization.

The EBITDA is used by the Management to monitor and assess the operational performance of the Group and is not identified as an accounting item within IFRS. Given that the composition of this measure is not regulated by the reference accounting standards, it is not subject to any audit procedure by the Independent Auditors.

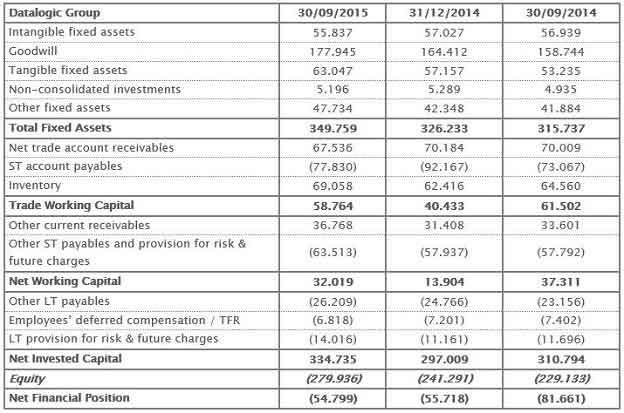

Reclassified Balance Sheet at 30th September 2015 (2) – Euro/1.000

2 The reclassified Balance Sheet shows measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

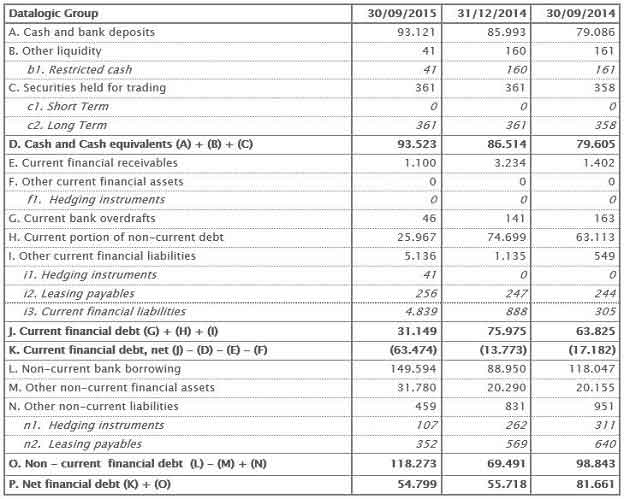

Net Financial Position at 30th September 2015 – Euro/1.000

|