|

• Sales revenues up 10.7% at 135.4 million Euro compared to 122.3 million Euro in the first quarter of 2015 (+9.6% net of Euro/Dollar exchange rate effect)

• EBITDA up 19.9% at 18.8 million Euro compared to 15.7 million Euro of the first quarter of 2015 (+21.8% net of Euro/Dollar exchange rate effect)

• Net profit at 10.1 million Euro substantially in line compared to the first quarter of 2015

• Consolidated net financial debt at 34.7 million Euro compared to 21 million Euro at 31st December 2015 due to regular growth in Trade Working Capital during the first quarter of the year

Bologna, 13th May 2016 – Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”), a global leader in Automatic Data Capture and Industrial Automation markets, and world-class producer of bar code readers, mobile computers, sensors for detection, measurement and safety, vision systems and laser marking equipment, approved today the Quarterly Financial Report at 31st March 2016.

First quarter closes with a net profit of 10.1 million Euro, a slight increase compared to first quarter 2015, highlighting significant growth of all of the key economic indicators, mainly due to sharp growth of the European and North American market in the Retail segments. EBITDA grew 19.9% to 18.8 million Euro, due to the improvement in operational leverage.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: "The year's first quarter results show an increase in revenues and in the operating margin. Performance levels in the United States and Europe are highly positive, mainly due to the segment of handheld readers and fixed scanners with imaging technology in the retail market, and to growth in Industrial Automation revenues in Europe and of the Systems division, which benefitted from the Royal Mail order. With regard to margins, we expect to benefit from production reorganisation measures starting from the subsequent quarters."

Consolidated sales revenues during first quarter 2016 amounted to 135.4 million Euro, up 10.7% compared to the first quarter 2015 (+9.6% at constant EUR/USD rates). Booking during the quarter - orders already received – amounted to 140.5 million Euro, down 1.6% compared to the same period of the previous year. This decline is mainly due to a large order received in first quarter 2015 in the North American retail segment: net of this order, booking would have grown by 5.6%. The ratio of orders to revenues for the period was approximately 104%.

The impact of new products [1] on revenues for the period was 27.6% compared to 25% in first quarter 2015.

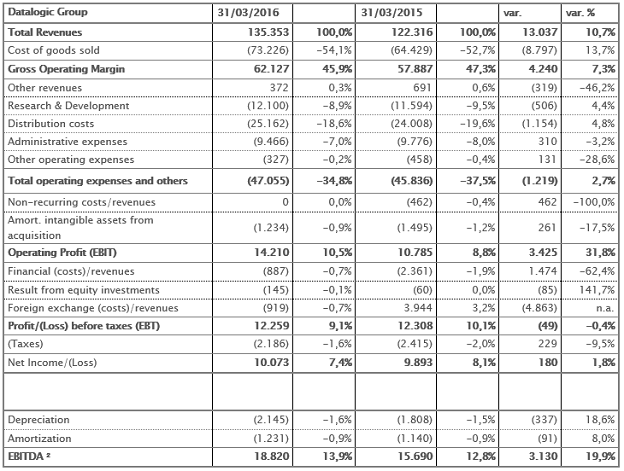

Gross operating margin grew by 7.3% to 62.1 million Euro compared to 57.9 million Euro during the same period of the prior year (+7.1% at constant EUR/USD rates), and its incidence with regard to revenues fell from 47.3% to 45.9%, due to an increase in the cost of materials.

Operating costs, equal to 47.1 million Euro, grew by 2.7% (at constant rates, the increase would have been 1.7%) compared to 45.8 million Euro in first quarter 2015, representing 34.8% of revenues, down compared to 37.5% in the corresponding period of the prior year. This trend reflects measures aimed at containing general administrative expenses, down 3.2% to the benefit of Research and Development expenses, which grew 4.4% to 12.1 million Euro, 8.9% of revenues.

Group EBITDA grew 19.9% to 18.8 million Euro, compared to 15.7 million Euro in first quarter 2015 (+21.8% at constant EUR/USD rates), with improvement in the EBITDA margin during the quarter from 12.8% to 13.9%.

Financial expenses, at negative 0.9 million Euro, declined sharply compared to the first quarter of the prior year, which amounted to 2.4 million Euro, due to the reduction in the average financial position for the quarter compared to first quarter 2015 and to the lower cost of debt following stipulation, in February 2015, of a new loan agreement with a pool of banks. Foreign exchange losses of 0.9 million Euro were recorded, compared to foreign exchange gains of 3.9 million Euro in first quarter 2015.

The Group's net profit amounted to 10.1 million Euro, up slightly compared to 9.9 million Euro achieved in the same period of the prior year.

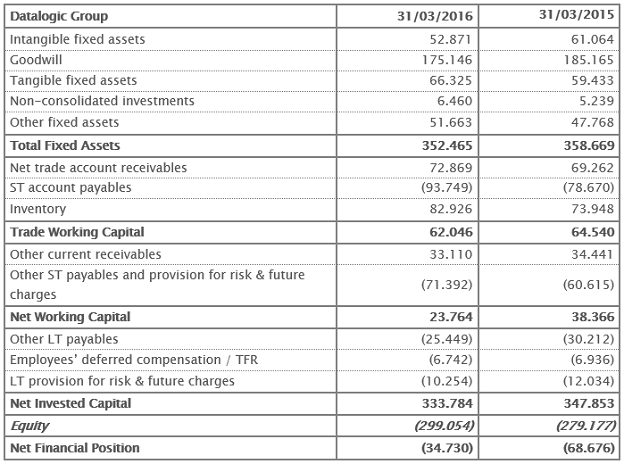

Net financial debt as at 31st March 2016 amounted to 34.7 million Euro, compared to 21 million Euro as at 31 December 2015. The change is mainly due to investments during the period and to the regular growth in Trade Working Capital during the first quarter of each year, equal to 62.0 million Euro, compared to 36.5 million Euro as at 31st December 2015.

1 New products refer to products launched in the last 24 months.

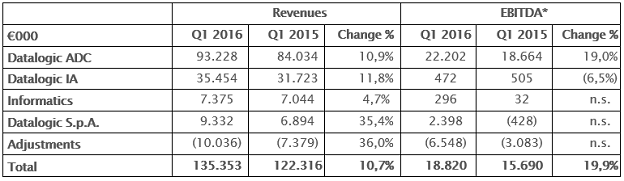

Comparison between first quarter 2016 and first quarter 2015

PERFORMANCE BY DIVISION

(*) With the purpose to better report the operating sectors economic performances, it was deemed appropriate to highlight the Divisional EBITDA as monitoring KPI.

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, continues to highlight a very positive trend in all key countries, particularly in EMEA and North America, due to ongoing product innovation. The Division registered revenues of 93.2 million Euro up by +10.9% (+9.9% at constant exchange rates) compared to 84 million Euro in the first quarter of 2015 and an EBITDA of 22.2 million Euro equal to 23.8% of revenues, up 19% compared to 18.7 million Euro in first quarter 2015 (EBITDA margin of 22.2%).

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market registered revenues of 35.5 million Euro, showing a growth of 11.8% compared to the first quarter of 2015 (+10.9% at constant exchange rates). Revenues of the division increased by 6.5% to 30.7 million Euro (+5.9% at constant exchange rates), excluding the results of the Systems Business Unit, which benefitted from the order by Royal Mail and from other new customers in the postal and retail segment. EBITDA amounts to 0.5 million Euro (EBITDA margin of 1.3%), essentially in line with the first quarter of the prior year. Margins were impacted by a number of delays in the measures for recovery of productive efficiency and additional costs with regard to the new production plant in Hungary, which began operating in April 2016 and the effects of which will be observed during the year.

Lastly, Informatics registered revenues of 7.4 million Euro compared to 7.0 million Euro in the first quarter of 2015, showing a growth of 4.7% (+2.5% at constant exchange rate).

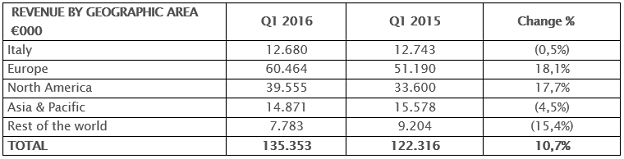

With regard to geographical areas, the European market showed positive performance in first quarter 2016, with 18.1% growth, to 60.5 million Euro. The trend in sales in the north American market was also very positive (+17.7% to 39.6 million Euro), mainly in the Retail segment.

PERIOD EVENTS

On 4th March 2016, following the resignation of Sergio Borgheresi, Stefano Biordi was appointed as Group CFO ad interim of Datalogic and as Manager responsible for preparing the company's financial reports and Vincenza Colucci was appointed as Investor Relator of Datalogic.

SUBSEQUENT EVENTS

On 16th April 2016, a new industrial plant of 7,000 sqm was inaugurated in Balatonboglar, Hungary, dedicated mainly to the production of Factory Automation equipment. The objective of this investment, amounting to over 9 million Euro during the period 2014-2016, is twofold: on the one hand, to expand production capacity in accordance with the Group's growth plans, and on the other, to ensure greater flexibility and the utmost quality in the production process, thanks to the introduction of three new SMT lines.

On 2nd May 2016, the Shareholders' Meeting, among other things, appointed the company's new Board of Statutory Auditors for the three-year period 2016/2018:

- Salvatore Marco Andrea Fiorenza - Chairman;

- Roberto Santagostino - Statutory auditor;

- Elena Lancellotti - Statutory auditor.

Today, pursuant to and in accordance with application criterion 8.C.1. of the Governance Code of Borsa Italiana ("Code") - with which Datalogic complies - the Board of Statutory Auditors informed the Board of Directors about the results of the assessment conducted with regard to the independence of its members, acknowledging that all of the Statutory Auditors possess the requirements of independence, also based on the criteria envisaged by the Code with regard to Directors.In consideration of the results of the aforementioned assessment by the Board of Statutory Auditors, as well as the documentation and information available to the Company, the Board of Directors - also in accordance with and pursuant to Art. 144-novies of the Consob Issuer Regulation - was able to ascertain, with regard to each member of the Board of Statutory Auditors, the existence of the independence requirements also pursuant to and in accordance with Art. 148, paragraph 3 of the Consolidated Law on Finance.

OUTLOOK FOR CURRENT YEAR

First quarter results confirm the Group's positive trend, particularly in the European and North American market, recording double-digit growth compared to the same quarter of 2015 (respectively, +12.2% and +15.3% at constant EUR/USD rates). This growth illustrates the market's appreciation for technological solutions arising from intensive research and development work and a more targeted response, with a specific focus on the range of applications aimed at the retail, transport and logistics, manufacturing industry and health sectors.

The Group will continue to make significant investments in R&D and will benefit, starting from the second half of the year, from the expected positive effects of the optimisation of production and operating costs underway, with projects for reorganisation and centralisation of the Group's activities and functions.

***

Please note that the Interim Management Statement at 31st March 2016 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports – Stefano Biordi – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st March 2016 – Euro/1.000

2 EBITDA - Earnings before interest, taxes, depreciation and amortization.

The EBITDA is used by the Management to monitor and assess the operational performance of the Group and is not identified as an accounting item within IFRS. Given that the composition of this measure is not regulated by the reference accounting standards, it is not subject to any audit procedure by the Independent Auditors.

Reclassified Balance Sheet at 31st March 2016 ( ) – Euro/1.000

3 The reclassified Balance Sheet shows measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

Net Financial Position at 31st March 2016 – Euro/1.000

|