|

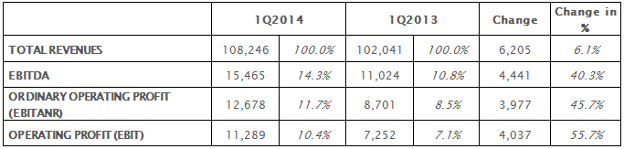

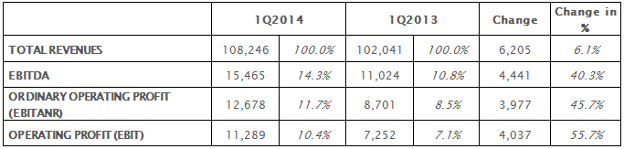

• Sales revenues at 108.2 million Euro, +6.1% compared to 102.0 million Euro in the first quarter of 2013

• EBITDA at 15.5 million Euro, +40.3% compared to 11.0 million Euro in the first quarter of 2013; EBITDA Margin at 14.3% from 10.8%

• Net profit at 6.9 million Euro, +13.7% compared to 6.1 million Euro in the first quarter of 2013

• Consolidated net financial debt stable at 97.3 million Euro compared to 97.0 million Euro at 31st December 2013

Bologna, 7th May 2014 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the Quarterly Financial Report at 31st March 2014.

The results for the first quarter, which closed with a growth of +40.3% of the EBITDA at 15.5 million Euro and a growth of +13.7% of the net profit at 6.9 million Euro, show significant growth in all the main performance indicators and confirm the recovery that began in the second half of the previous year.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: “The first-quarter results confirm and strengthen the positive trend that began in the second half of last year, both in terms of sales growth and the improvement in profitability. The products launched in 2013, particularly in the retail segment, continue to do well on all core markets, particularly in the US. During the quarter, we also continued to increase investment in research and development, the real driver of the Group’s recovery, and investment in markets undergoing rapid expansion, which show double-digit growth. We also opened new offices in Turkey and Brazil in order to move closer to our customers and partners. Profitability further improved on the back of the positive strategic decisions taken in the recent past. Considering the bookings trend in the quarter, we are optimistic about the performance of the retail segment for the whole year”.

Consolidated sales revenues for the first quarter of 2014 came in at 108.2 million Euro, +6.1% compared to 102.0 million Euro in the same period of the preceding year. At constant Euro/Dollar exchange rate the increase versus the previous year would have been 7.8%. The booking during the quarter – the orders already received - was equal to 116 million Euro (book to bill ratio in the period equal to approx. 107%).

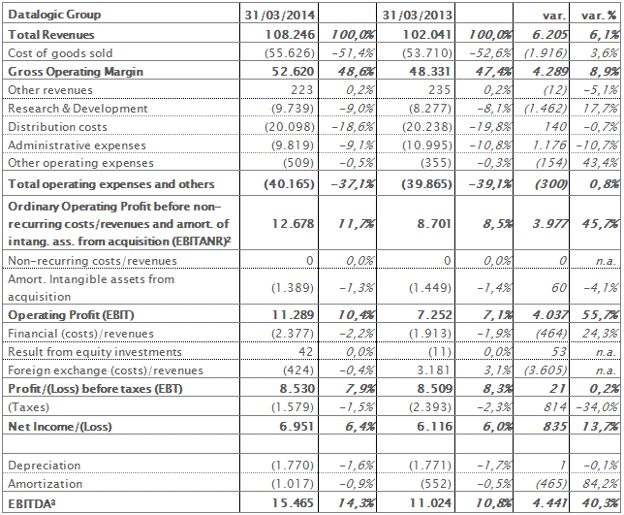

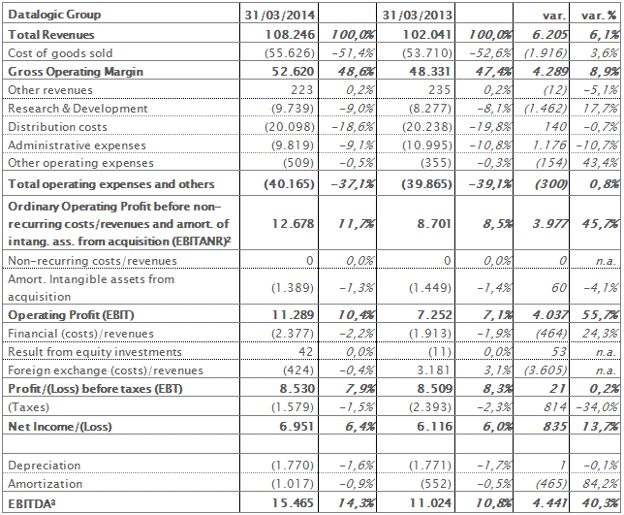

Gross operating margin came in at 52.6 million Euro compared to 48.3 million Euro in the same period of the preceding year, up 1.2 points as a percentage of total revenues, from 47.4% to 48.6%.

Group EBITDA increased by more than 40% from 11.0 million Euro in the first quarter of 2013 to 15.5 million Euro, while the EBITDA margin advanced from 10.8% to 14.3%. General & Administrative expenses fell by 10.7% to 9.8 million Euro on the back of cost-cutting measures.

Investment in research and development continued to rise, both in absolute terms, from 8.3 million Euro in the first quarter of 2013 to 9.7 million Euro, and as a percentage of revenues, from 8.1% to 9.0%. This is considered fundamental for business growth, and confirms the strategy launched in the previous year.

EBITANR[1] came in at 12.7 million Euro up by 45.7% compared to 8.7 million Euro in the first quarter of 2013.

After financial charges of 2.4 million Euro compared to 1.9 million Euro in the first quarter of 2013 and foreign exchange costs for 0.4 million Euro compared to foreign exchange revenues for 3.2 million Euro in the first quarter 2013, Group net profit came at 6.9 million Euro compared to 6.1 million Euro realized in the same period of the preceding year.

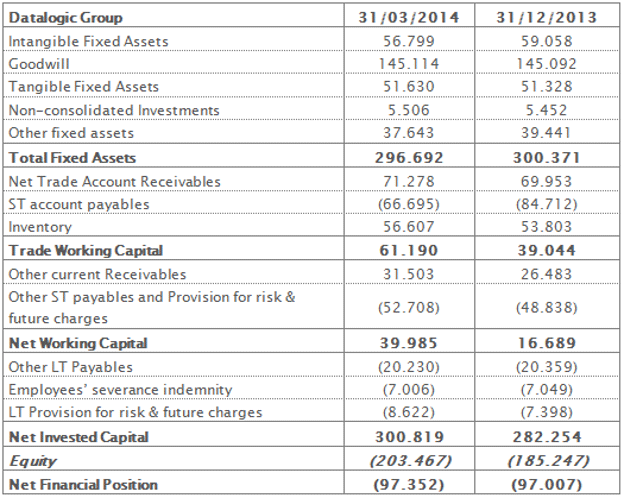

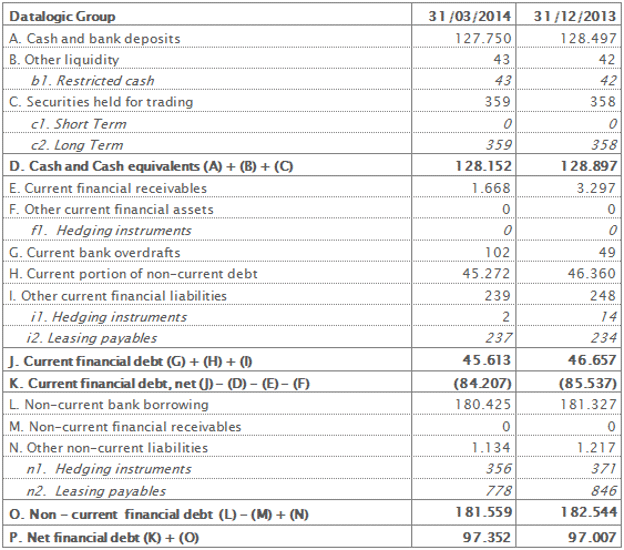

As at 31st March 2014, net financial debt was negative at 97.3 million Euro, substantially in line with 97.0 million Euro at 31st December 2013, and improved compared to 122.0 million Euro at 31st March 2013 thanks to continuous cash generation. Trade working capital was 61.2 million Euro at 31st March 2014 up from 39.0 million Euro on 31st December 2013.

[1] EBITANR – Earnings before interest, taxes, acquisition and non-recurring.

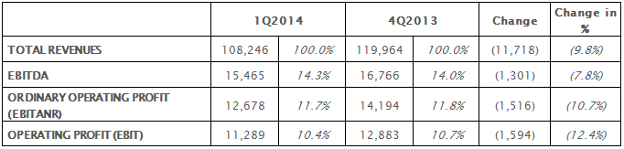

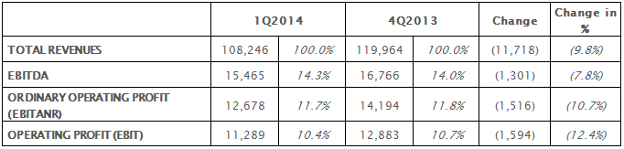

Comparison between first quarter 2014 and first quarter 2013 and between first quarter 2014 and fourth quarter 2013

In comparison with the fourth quarter of 2013 (top-line down approx. 9.8%), it should be noted that the fourth quarter is statistically the best quarter of the year concerning revenues.

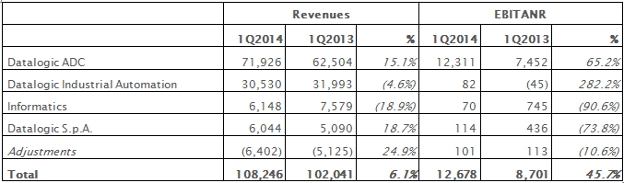

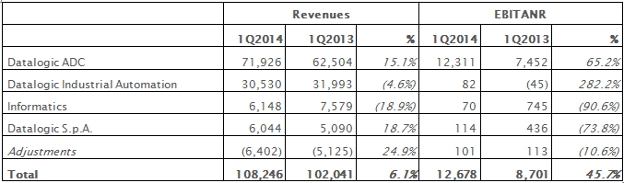

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) for the first three months of 2014 for the individual Operating Divisions.

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, registered revenues of 71.9 million Euro, +15.1% compared to 62.5 million Euro of the first quarter of 2013 and down compared to 79.8 million Euro of the fourth quarter of 2013. This division has registered significant growth in all the reference markets, especially in the retail sector, and it continues to benefit of new products that were launched last year, in particular those in the fixed scanner segment.

The Industrial Automation Division, specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, registered revenues of 30.5 million Euro, down by 4.6% compared to 32.0 million Euro in the first quarter of 2013 and -7.3% compared to 32.9 million Euro in the fourth quarter of 2013. The smaller contribution the division made compared to the previous quarter is mainly due to the Transportation & Logistic sector in the US market. Positive trends have been registered for all the other reference market.

At the end Informatics registered sales of 6.1 million Euro compared to 7.6 million Euro in the first quarter of 2013 and 7.4 million Euro in the fourth quarter of 2013.

With regard to geographical regions, the European market posted a positive performance in the first quarter of 2014, with growth of 13.4% to 46.9 million Euro. Italy, in particular, registered growth of 25.8% to 12.0 million Euro. The weakness on the North American market, which posted a decline in sales of 12.7% to 30.0 million Euro, was mainly due to the Industrial Automation segment, which saw sales fall by 37%, not completely offset by growth of 17% in the ADC segment. There was a positive trend in sales in the emerging markets of Asia and the rest of the world, which grew by 7.2% to 11.9 million Euro and by 32.5% to 7.3 million Euro respectively.

PERIOD EVENTS

During the quarter a placement of n. 6,295,018 ordinary shares, equal to 10.8% of the share capital, through an Accelerated Bookbuilding procedure addressed exclusively to institutional investors, was completed.

Please note also that in the month of March, JP Morgan Asset Management Holdings Inc. and Norges Bank entered the capital of Datalogic SpA with a shareholding respectively equal to 2.438% and 2.45%.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

The first-quarter results confirm the positive trend that began in the second half of 2013, and validate the strategic decisions taken by the company. Note in particular the growth registered by the ADC division, which was mainly due to the success, especially in the US, of the new products launched on the market in 2013.

For the rest of 2014 we expect a continuation of the positive trend of the ADC and the recovery of Industrial Automation in the second half of the year.

Please note that the Interim Management Statement at 31st March 2014 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports - Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st March 2014 – Euro/1.000

Nota: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[2] EBITANR – Earnings before interest, taxes, acquisition and non-recurring.

[3] EBITDA - Earnings before interest, taxes, depreciation and amortization.

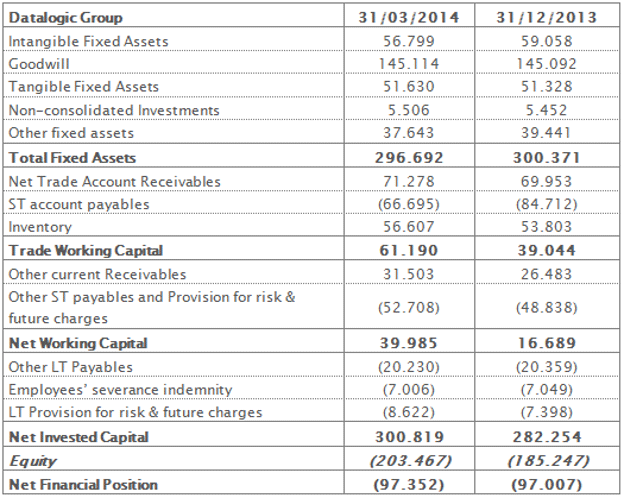

Reclassified Balance Sheet at 31st March 2014 – Euro/1.000

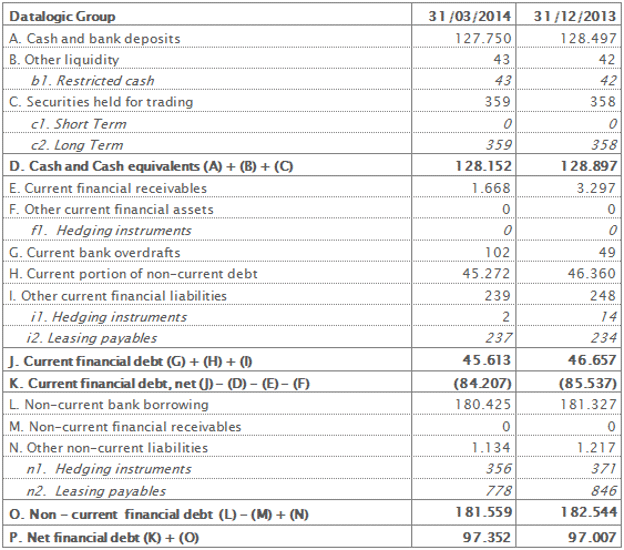

Net Financial Position at 31st March 2014 – Euro/1.000

|