Press Releases

Press Releases

The Board of Directors approved the Quarterly Report at 31st March 2013

|

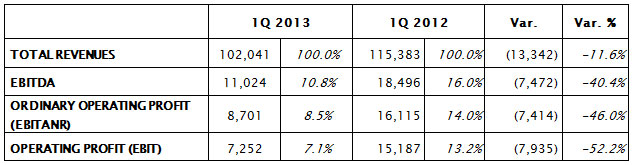

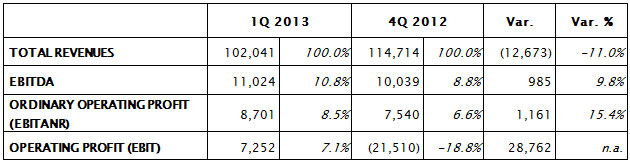

• Sales revenues at 102.0 million Euro compared to 115.4 million Euro in the first quarter of 2012 • EBITDA at 11.0 million Euro compared to 18.5 million Euro in the first quarter of 2012 • Net profit at 6.1 million Euro compared to 10.0 million Euro in the first quarter of 2012 • Net financial debt stable at 122.0 million Euro compared to 121.1 million Euro at 31st December 2012 Bologna, 9th May 2013 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, today approved the Quarterly Financial Report at 31st March 2013. The results for the first quarter of 2013, which closed with net profit of 6.1 million Euro versus 10.0 million Euro in the same quarter of 2012, reflect the weakness of the reference markets, particularly in the ADC (Automatic Data Capture) segment, which was affected by the sharp slowdown in investment by the retail sector. Romano Volta, Chairman and CEO of Datalogic Group, commented: “The first quarter was affected by the wait-and-see attitude of the main retailers, who limited their investments to replacements, and by the postponement to the second quarter of the launch of new products in the T&L and manufacturing sectors. Although these results fall short of what was achieved in the first quarter of last year, Datalogic decided to step up its investments in R&D both in absolute and percentage terms, in order to ensure the development and launch of new products, which are essential for our growth. Consolidated sales revenues for the first quarter of 2013 came in at 102.0 million Euro, down by 11.6% y/y compared to 115.4 million Euro achieved in the same period of the previous year (-11.2% at constant Euro/Dollar exchange rates). Note that in the first quarter of 2012, the “Other Revenues” benefited from revenues from a sale of certain assets, such as patents, know-how and other intangible fixed assets related to the radio frequency identification (RFID) business, which raised 5.5 million Euro. [1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

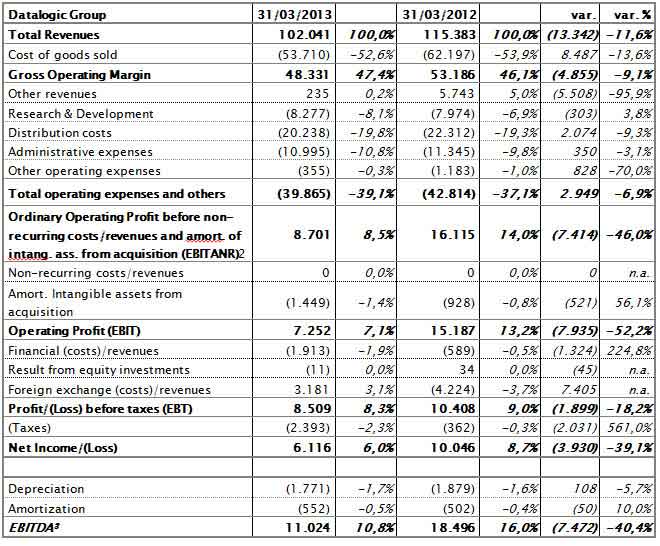

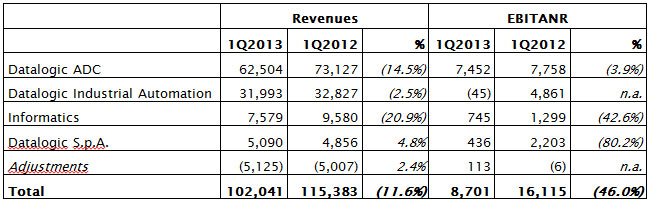

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) for the first three months of 2013 for the individual Operating Divisions.  By geographical region, in the first quarter of 2013, the European market continued to register a negative trend in sales, which fell by 16% to 39.9 million Euro, in which it was followed by the North American market, where sales shrank by 10% to 34.5 million Euro. However, there was a positive trend in sales in the emerging markets of Asia and Latin America, which registered 4% growth to 7 million Euro. Reclassified income statement at 31st March 2013 – Euro/1.000

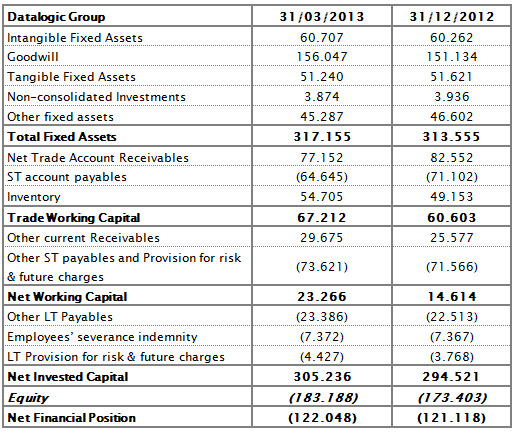

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements. [1] EBITANR – Earnings before interest, taxes, acquisition and non recurring Reclassified Balance Sheet at 31st March 2013 – Euro/1.000

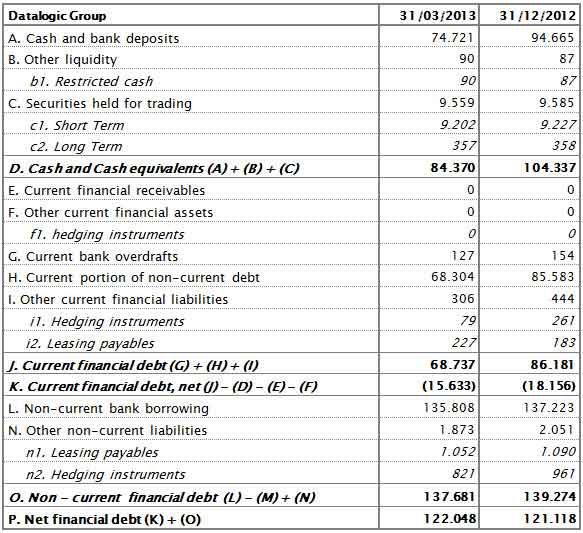

Net Financial Position at 31st March 2013 – Euro/1.000

|