|

• Sales revenues at 257.5 million Euro, +14.9% compared to the previous year

• EBITDA at 34.3 million Euro stable compared to the first half of 2014

• Net profit up +40.7% at 21.5 million Euro compared to 15.2 million Euro in the first half of 2014

• Consolidated net financial debt at 58.4 million Euro compared to 55.7 million Euro at 31st December 2014

Bologna, 30th July 2015 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the Half-Year Report at 30th June 2015.

The results of the first half of the year, that closed with an increase of 40.7% in net profit at 21.5 million Euro, confirm the positive trend in terms of growth of revenues for all the divisions. EBITDA remained substantially stable at 34.3 million Euro, notwithstanding the negative impact of the exchange rate trend and continued investments in Research and Development and in the distribution network aimed at re-launching the Group on the North American market.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: “The positive results of the first half of the year reinforce the effectiveness of the strategic choices, made at management and product level, undertaken and that enabled a double-digit growth in Europe and in Asian countries. Retail was confirmed as the driver of such a growth, but in H1 there was also a recovery in the industrial sector thanks to the introduction on the market of new products based on imaging technology for the logistics and factory automation sectors which are growing in Europe. The contract secured with Royal Mail also constitutes an interesting prospect for re-launching the Systems business unit in line with other Group activities."

Sales revenues came in at 257.5 million Euro, with a growth of 14.9% compared to 224.0 million Euro in the first half of 2014 (+5.0% at constant exchange rates). The booking - the orders already received - reached 271.5 million Euro, +16.8% compared to the same period of 2014.

The impact of the new products on revenue in Q2 was 26.4%, that is a continuation of the positive trend established in the first quarter (25.0%) and a confirmation of the success of the technological innovation.

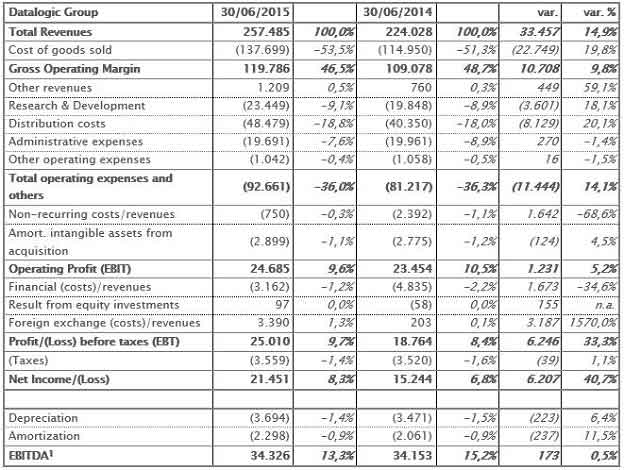

Gross operating margin came in at 119.8 million Euro, +9.8% compared to 109.1 million Euro of the same period of the previous year (+3.9% at constant exchange rates).

Operational costs, at 92.7 million Euro, increased by 14.1% (the increase would have been 5.1% at constant exchange rates) compared to 81.2 million Euro of H1 2014 highlighting a 36.0% incidence on revenue slightly less than the 36.3% of H1 2014. The cost of Research and Development grew both in absolute value, from 19.8 million Euro to 23.4 million Euro, and in terms of incidence on revenues (from 8.9% to 9.1%), as a result of the increasing importance that the Group attributes to it, while the cost of distribution increased from 40.4 million Euro to 48.5 million Euro (with incidence on revenue going from 18.0% to 18.8%) mainly due to the strengthening of the distribution network in the United States.

The EBITDA was almost stable at 34.3 million Euro compared to 34.2 million Euro of H1 2014 (+1.6% at constant exchange rates) while incidence on revenue (EBITDA margin) was down to 13.3% with respect to 15.2%. The reduced margin is in part attributable to the exchange rate effect. Excluding the exchange rate effect, the EBITDA margin would have been 14.7%.

The Operating Result grew by 5.2% to 24.7 million Euro with respect to 23.5 million Euro (+11.3% at constant exchange rates).

After the effect of financial charges for an amount of 3.2 million Euro compared to 4.8 million Euro in H1 2014, a diminishing amount thanks to the effect of a new financing contract with a banking pool, and revenues on exchange rates for an amount of 3.4 million Euro compared to a profit of 0.2 million Euro in H1 2014, the net profit for the Group stands at 21.5 million Euro, representing a 40.7% growth with respect to 15.2 million Euro in H1 2014.

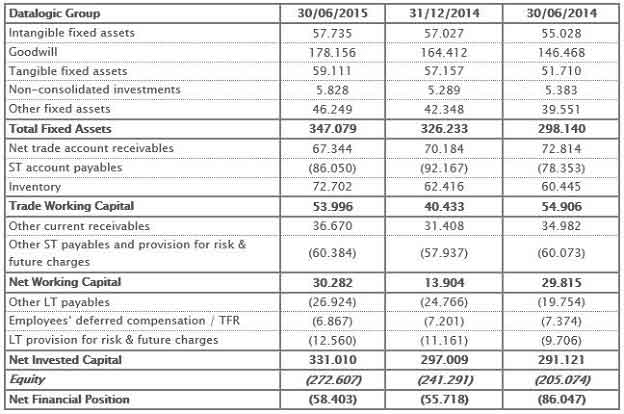

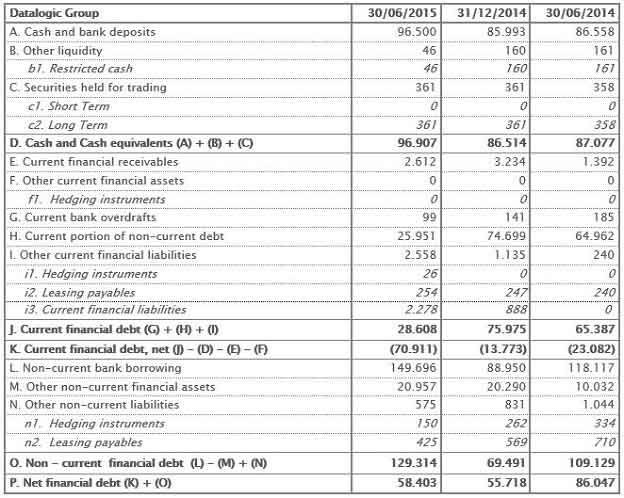

As of 30th June 2015, net financial debt was 58.4 million Euro, compared to 55.7 million Euro as of 31st December 2014 and 86.0 million Euro as of 30th June 2014.

The net working capital as at 30th June 2015 was recorded at 30.3 million Euro, a value that is substantially aligned with 29.8 million Euro as at 30th June 2014.

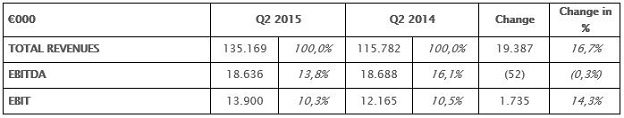

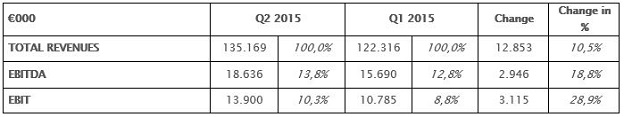

QUARTERLY TREND

Sales revenues in Q2 2015 stood at 135.2 million Euro representing a growth of 16.7% with respect to Q2 2014 (at constant exchange rates revenues would have been 122.9 million Euro, +6.1%) and a growth of 10.5% with respect to Q1 2015. Even though the operating margins prove to be decreasing slightly due to the same dynamics that were highlighted for the half yearly results and, in particular the negative effect of exchange rates, a recovery in margins at EBIT level should be noted.

Comparison between second quarter 2015 and second quarter 2014

Comparison between second quarter 2015 and first quarter 2015

PERFORMANCE BY DIVISION

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, registered revenues of 177.4 million Euro, + 19.0% compared to the first half of 2014. Such improvement is significant even at constant exchange rates (+8.8%) thanks to the contribution of important in-counter scanner and handheld reader projects in the Retail sector. EBITDA grew by 18.7% to 36.5 million Euro with a substantial unchanging margin of 20.5%.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, registered revenues of 66.6 million Euro, showing a growth of 6.2% with respect to H1 2014 (-0.9% at constant exchange rates). Net of the results of the Systems Business Unit, the revenues of the division increased by 11% to 60.4 million Euro (+4.6% at constant exchange rates), which confirms the validity of the offered product and highlights a particularly positive trend in the European and Asian markets. In the second half of the year an improvement is expected even for the Systems BU as it starts to enjoy the benefit of revenues generated by the Royal Mail order. Regarding operational margin, the division shows the negative effect of greater investment in Research and Development that rose from 11.5% to 12.7% of revenues, and in the distribution network mainly in the United States where investment rose from 23.7% to 27.7% of revenues. Net of the results of the Systems BU, the gross operating margin is 7.4% of the revenue.

Finally Informatics registered sales of 14.5 million Euro, +10.7% compared to 13.1 million Euro in the first half of 2014.

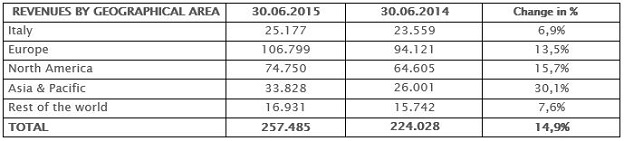

PERFORMANCE BY GEOGRAPHICAL AREA

Regarding geographic areas, in H1 2015 there was a positive trend in the European market with a 13.5% growth to 106.8 million Euro. The sales trend in the emerging markets in Asia was very positive growing by 30.1% to 33.8 million Euro. The result in North America which rose to 74.8 million Euro is above all due to the exchange rate effect.

PERIOD EVENTS

On 25th February 2015 a medium term debt refinancing was completed. The refinancing contract, signed with a Banking Pool, is worth 140 million Euro with an interest rate that reflects market rates and a five year repayment term with covenants that are substantially in line with the best practice of Datalogic Group for this kind of transaction.

On 29th May an agreement was signed with Royal Mail to implement a new Parcel Sorting System in around 20 mail centres across the UK. The total value of the deal is approximately 29 million Euro.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

The results of H1 confirm the positive trend of the Group above all in the European Market. Such growth demonstrates how the market appreciates technological solutions which are the result of intense Research and Development activity and close co-operation with our customers.

Considering also the positive trend in revenue booking in H1, it is expected that in H2 2015 there will be continued growth in the European and Asian markets and a market recovery in the United States. In particular, the Industrial Automation division will enjoy the benefit of revenue from projects in the Transportation, Logistics and Postal segments as well as the Factory Automation sector thanks to the launching of new top of the range products in Q3.

Major investment in Research and Development which is now over 9% in terms of incidence on revenue, will continue; innovation is confirmed as the main pillar of Datalogic's future, thanks to the revenue growth generated by new products.

***

Please note that the half-year interim report will be available upon request at the registered office of Datalogic S.p.A. and at the offices of Borsa Italiana S.p.A., and it could also be consulted on the Company’s web site www.datalogic.com (Investor Relations section).

The manager responsible for preparing the company’s financial reports – Sergio Borgheresi – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th June 2015 – Euro/1.000

[1] EBITDA - Earnings before interest, taxes, depreciation and amortization. The EBITDA is used by the Management to monitor and assess the operational performance of the Group and is not identified as an accounting item within IFRS. Given that the composition of this measure is not regulated by the reference accounting standards, it is not subject to any audit procedure by the Independent Auditors.

Reclassified Balance Sheet at 30th June 2015 [2]– Euro/1.000

[2] The reclassified Balance Sheet shows measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

Net Financial Position at 30th June 2015 – Euro/1.000

|