|

• Sales revenues at 218.8 million Euro compared to 236.9 million Euro in the first half of 2012

• EBITDA at 26.2 million Euro compared to 40.6 million Euro in the first half of 2012

• Net profit at 10.2 million Euro compared to 26.6 million Euro in the first half of 2012

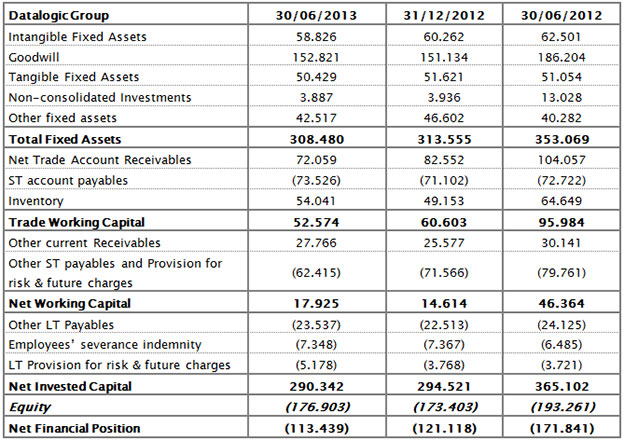

• Consolidated net financial debt improved at 113.4 million Euro compared to 121.1 million Euro at 31st December 2012

• High cash generation has continued in this period: 14.5 million Euro net of non-recurring items

Bologna, 30th July 2013 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, today approved the half-year report at 30th June 2013.

The results for the first half of 2013, which closed with revenues of 218.8 million Euro and a net profit of 10.2 million Euro, still reflect the weak demand on the reference markets, in particular in the ADC (Automatic Data Capture) segment, characterized by a slowdown of the investments in the retail sector. The outlook for the second half of 2013, which has decisively improved compared to the first, shows signs of recovery thanks to the introduction of new products on both the reference markets.

Romano Volta, Chairman and CEO of Datalogic Group, commented: “The results for the half year reflect the particularly difficult situation in terms of demand and global recession. We are hopeful that the second half of the year will show growth thanks to the progressive improvement of sales and margins in the second half as well as other positive signs seen this month. In fact, despite the current contraction, the Group has increased its investments in Research and Development and has decided to strengthen its core technologies and the innovation of the products, guided by the market needs through the creation of the new Business Development Division. The fruit from these activities will be fundamental for the development of the business in the future.”

Sales revenues came in at 218.8 million Euro compared to 236.9 million Euro in the first half of 2012 (-7.6% y/y and -7.0% at constant Euro/Dollar exchange rate). The orders already received, during the second quarter, were equal to 119 million Euro, +3.5% compared to the second quarter of 2012.

Gross operating margin came in at 103.4 million Euro versus 113.1 million Euro in the same period last year, with a percentage on total revenues substantially stable at 47.3%.

EBITDA was 26.2 million Euro compared to 40.6 million Euro in the first half of 2012 (-35.5% y/y). This result benefited from approximately 5.5 million Euro in reveneus related to the sale of some assets, such as patents, expertise and other intangible fixed assets related to a non-core business of the Group. The slowdown in revenues was reflected in the margins for the period, the EBITDA margin declined to 12.0% owing, in fact, to the greater incidence of fixed costs on sales volumes. There has been a significant increase in Research and Development investments, totalling 17.4 million Euro compared to 15.9 million Euro in the first half of 2012 with a 9.5% growth and a revenue incidence that went from 6.7% to 8%.

EBITANR was 21.2 million Euro compared to 35.6 million Euro in the first half of 2012 (-40.4% y/y).

After financial charges of 4.2 million Euro compared to about 4 million Euro in the first half of 2012, foreign exchange costs for 1.1 million Euro compared to foreign exchange revenues for 4.5 million Euro in the first half 2012 and taxes for about 4 million Euro compared to 5.4 million Euro in the first half of 2012, Group net profit came at 10.2 million Euro compared to 26.6 million Euro realized in the first half of the preceding year.

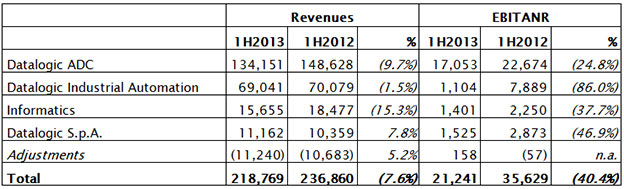

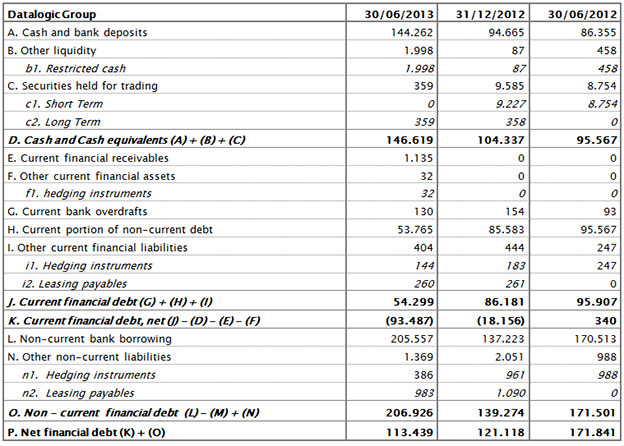

The net financial position on 30th June 2013 was negative at 113.4 million Euro, an increase compared to 121.1 million Euro at 31st December 2012 and 122 million Euro on 31st March 2013 thanks to the continuous cash generation (14.5 million Euro net of non-recurring items).

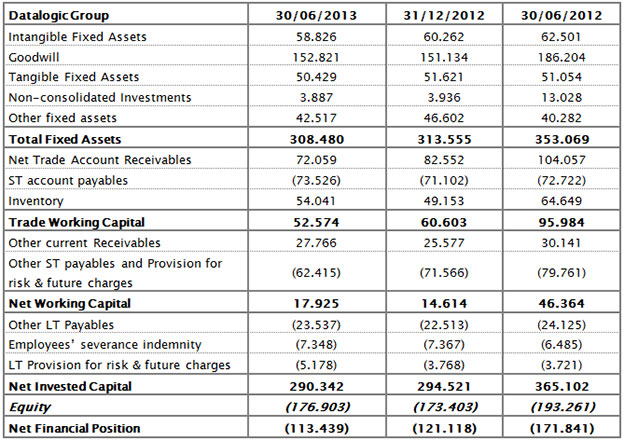

Trade working capital was 17.9 million Euro compared to 23.3 million Euro at 31st March 2013 and 14.6 million Euro at 31st December 2012.

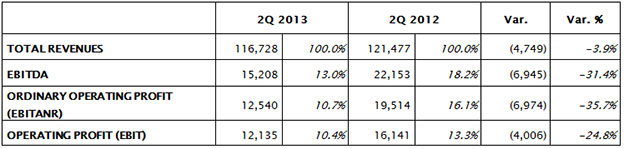

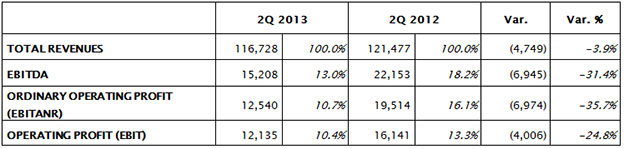

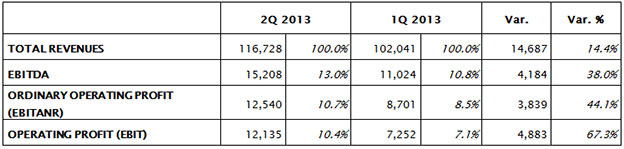

For the quarter, the results in the second quarter of 2013 have clearly improved compared to the first quarter of the year, primarily due to the increased revenues and improved margins. In particular, the sales revenue totalled 116.7 million Euro (+14.4% compared to the previous quarter and -3.9% compared to the second quarter of 2012). The EBITDA totalled 15.2 million Euro (+38% compared to the first quarter of 2013 and -31.4% compared to the second quarter of 2012) and the EBITANR totalled 12.5 million Euro (+44.1% compared to the first quarter of 2013 and -35.7% compared to the second quarter of 2012).

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

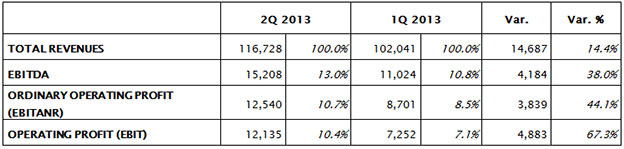

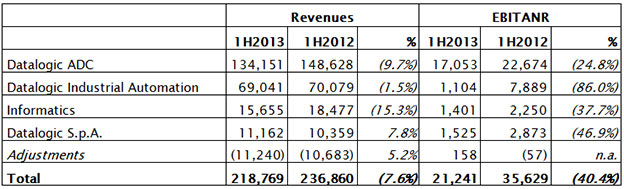

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) for the first six months of 2013 for the individual Operating Divisions.

The ADC Division (Automatic Data Capture) registered revenues of 134.2 million Euro (148.6 million Euro in the first half of 2012). This division, which has improved significantly compared to the first quarter of the year, is still feeling the impact of the “wait and see” approach in the retail sector. The interest of the large retailers in the introduction, in particular of two unique and technologically advanced products, remains very high.

The Industrial Automation Division registered revenues of 69.0 million Euro, down by 1.5% compared to the first half of 2012. The outlook is substantially positive for factory automation thanks to more focus on sensors and safety light curtains and the positive trend for smart cameras used for production line inspection and quality control. We instead expect a recovery in the sale of barcode readers for T&L (Transportation&Logistics) in the second quarter due to the postponement of important projects.

At the end Informatics registered sales of 15.7 million Euro compared to 18.5 million Euro in the first half of 2012.

By geographical region, the first half of 2013 saw the European market continuing to perform badly, falling by 15% to 79.1 million Euro, in which it was followed by the North American market, which shrank by 9.5% to 75.3 million Euro. On the contrary, there was a positive trend in sales in the emerging markets of Asia and Latin America, which experienced 5% growth to 27.4 million Euro and 16% to 16.2 million Euro respectively.

PERIOD EVENTS

In the month of February, CEO Mauro Sacchetto resigned. The position was taken over by Romano Volta, formerly the Company Chairman.

In June, the company received amid-term pool loan for 110 million Euro. The loan has a duration of five years with the covenants broadly in line with those of similar loans taken out by the Group.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

The period that ended especially reflected a slowdown in investments on the main reference markets, particularly in the retail sector. For the second half of the year, we expect an increased demand thanks to the progressive improvement of the macro-economic indicators and the launch of new highly innovative products that can essentially impact the outlook for Group sales.

***

The auditing activity for the half-year interim report has not yet been completed and the audit report will be available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Lastly, please note that the half-year interim report will be available upon request at the registered office of Datalogic S.p.A. and at the offices of Borsa Italiana S.p.A., and it could also be consulted on the Company’s web site www.datalogic.com (Investor Relations section).

The manager responsible for preparing the company’s financial reports - Mr Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the Italian Legislative Decree no.58/1998, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th June 2013 – Euro/1.000

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

[1] EBITDA - Earnings before interest, taxes, depreciation and amortization

Reclassified Balance Sheet at 30th June 2013 – Euro/1.000

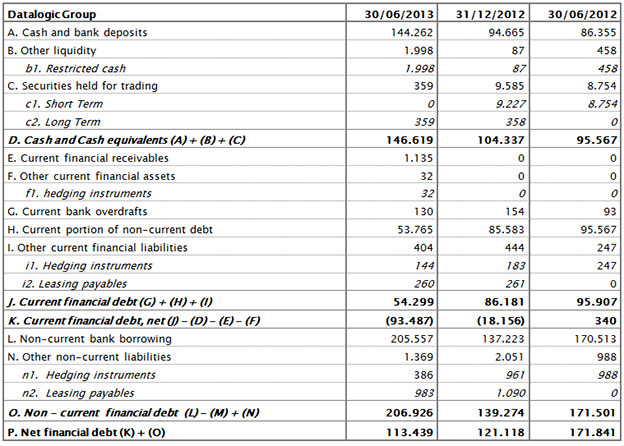

Net Financial Position at 30th June 2013 – Euro/1.000

|