Press Releases

Press Releases

Datalogic (Star: DAL.MI) - Half-year report at 30th June 2012 approved by Board of Directors.

|

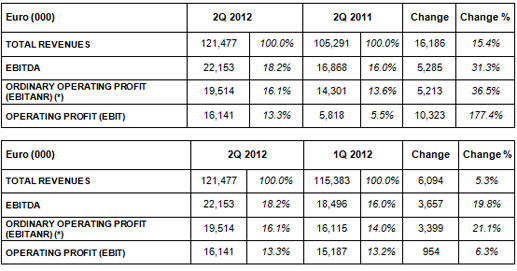

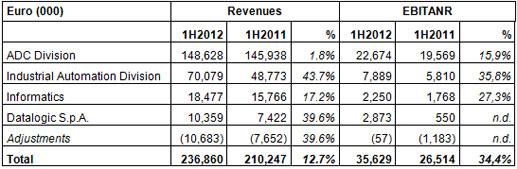

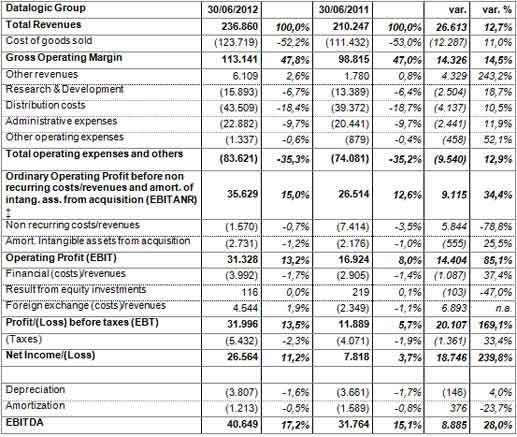

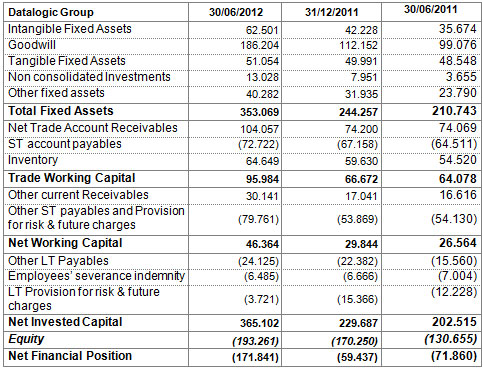

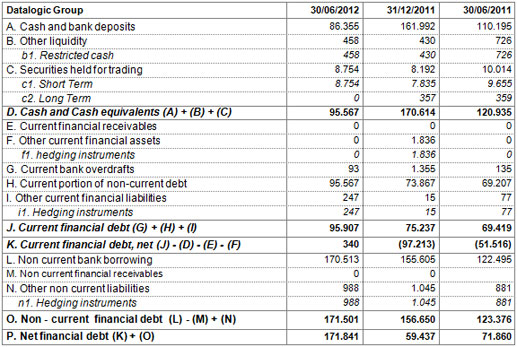

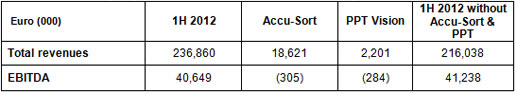

• The first half of 2012 showed strong growth of economic indicators despite weak demand growth and a recessive macroeconomic environment • Sales revenues at 236.9 million euros +12.7% compared to the same period in 2011 • Strong growth of net profit to 26.6 million euros from 7.8 million euros in the first half of 2011 • Net financial debt was 171.8 million euros following the acquisition of Accu-Sort Systems Inc. that was finalized in January Bologna, 30th July 2012 – Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed on the Mercato Telematico Azionario – Star Segment – of the Italian Stock Exchange Borsa Italiana S.p.A. (“Datalogic”), a global leader in Automatic Identification and total solutions provider of bar code readers, data collection mobile computers, RFID and vision systems, approved the half-year report at 30 June 2012. The first half of the year, when Accu-Sort Systems (on 20 January 2012) and PPT Vision were consolidated, showed strong growth in net profit of 26.6 million euros, compared to 7.8 million euros recorded in the first half of 2011, and an impressive increase in profitability. The CEO of the Datalogic Group, Mauro Sacchetto, commented: “We are satisfied with the results obtained during this half-year period, even taking into account the particularly difficult context for demand and the recessive global climate. Market slowdown inbusiness has not hindered continued growth of Datalogic, thanks especially to continuous product and process innovation and to R&D activities that this half-year have increased compared to last year. The improvements made by the Group in recent years, intended to optimize logistical and distribution processes, have enabled further progress in terms of profitability and structural cost reduction which will continue to give a positive impact on profitability. Integration of the acquired companies Accu-Sort Systems and PPT Vision into Datalogic Automation was successfully completed ahead of schedule during the half-year period, thus enhancing the global position of the Group in the industrial automation market. Moreover, the new organizational structure for the target markets - Automatic Data Capture (ADC) and Industrial Automation – the new Supply Chain in the ADC segment and the upgrading of the site in Vietnam, have as assumed, started to produce the first benefits that are expected to continue in subsequent quarters. Therefore we are not concerned about the challenge of an objectively more difficult market and we will continue to invest in the product portfolio and industrial processes to achieve improved economic and financial performance.” Sales revenues of 236.9 million euros demonstrated an increase of 12.7% compared to the first half of 2011. Revenues were boosted by the performance of the dollar; in fact at constant Euro/Dollar exchange rates, the increase compared to the previous year would have been equal to 7.7%. Sales revenues incorporate revenues from Accu-Sort Systems Inc. and PPT Vision Inc. for a total of 20.8 million euros. The EBITDA was 40.6 million euros with an increase of 28% compared to the first half of 2011 amounting to 31.8 million euros, confirming a further increase in profitability (the EBITDA margin was 17.2% compared to 15.1% in the first half of 2011). This result profits from approximately 5.5 million euros in revenues in the first quarter related to the sale of some assets, such as patents, expertise and other intangible fixed assets related to a non-core business of the Group, and to the gradual impact of the effects from the new Supply Chain related to the ADC segment. Costs for research and development, amounting to 15.9 million euros, were 6.7% compared to 6.4% of revenues recorded in the first half of 2011. The EBITDA of the Group, as shown in the following table, was impacted by the reorganization and integration of PPT Vision and Accu-Sort Systems, acquired between the end of 2011 and the beginnng of 2012.  As of 1 July 2012 Datalogic Automation, Accu-Sort Systems and PPT Vision have been integrated into the single entity of Datalogic Automation. The ordinary operating profit (EBITANR ) was 35.6 million euros (+34,4% compared to 26.5 million euros in the first half of 2011), with a turnover increase to 15% from 12.6% in the first half of 2011. After financial expenses of approximately 4 million euros compared to 2.9 million euros in the first half of 2011, foreign exchange gains totalling 4.5 million euros compared to losses of 2.3 million euros in the first half of 2011 and taxes and duties of 5.4 million euros compared to 4.1 million euros in the first half of 2011, Group net profit grew to 26.6 million euros compared to 7.8 million euros realised in the first half of the preceding year. The net financial position on 30 June 2012 was negative at 171.8 million euros compared to 59.4 million euros on 31 December 2011; this trend may be primarily attributed to the acquisition of holdings for the Accu-Sort Systems Group of 100.3 million euros. The net working capital was 46.4 million euros on 30 June 2012 an increase of 16.5 million euros compared to 31 December 2011 (at 29.8 million euros). Quarterly, the results for the second quarter of 2012 showed marked progress both in the second quarter of 2011 and in the first quarter of 2012 primarily in terms of improved profitability: in particular sales revenues were confirmed at 121.5 million euros (+15,4% in the second quarter of 2011 and +5,3% compared to the previous quarter), the EBITDA at 22.2 million euros (+31,3% compared to the second quarter of 2011 and +19.8% in the first quarter of 2012), and the ordinary operating profit (EBITANR) at 19.5 million euros (+36.5% compared to the second quarter of 2011 and +21.1% compared to the first quarter of 2012).

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring The Group’s new structure, effective as of 1st January 2012, is now organized per relevant market, a necessary step in order to provide integrated solutions at a global level. Therefore, the Group is now structured as follows:

Geographically evidence of strong sales performance in the North American markets, rose by 34% to 83.2 million euros, and in Europe it grew by 10% to 92.9 million euros. Events in the reporting period (1H12) The new ADC Division has been operating since January 2012. Acquisition of Accu-Sort Systems Inc. and its subsidiaries was finalized on 20 January 2012. Accu-Sort, headquartered in Telford, Pennsylvania, with approximately 80 patents, 57 of which are registered in the US, 250 employees, a production facility, two research centres, one in Europe and one in the US, and 8 business offices. Events after end of reporting period (1H12) Since 1 July 2012 Datalogic Automation, Accu-Sort Systems and PPT Vision have been integrated into a single entity that has strengthened the global position of the Group on the industrial automation market. THE OPERATIONAL OUTLOOK FOR THE CURRENT YEAR AND FUTURE EVENTS Despite the global economic environment confirming the negative forecasts of demand trend and strains on the financial market, the Group has increased its turnover, during the first half of 2012, compared to the previous year, besides benefits resulting from the acquisitions undertaken it has recorded, in addition, a consistent increase in profitability, both in terms of operating profit and net profit. Investments from the previous year, in fact, intended to optimize the logistical and distribution processes, have had and are expected to continue having a positive impact on profitability of the Group. The cost structure allows for maintenance of high profit levels even without increases in turnover. Hence, in the months to come, Datalogic will continue to invest in orders to enhance its product portfolio and subsequently streamline its industrial processes in order to attain the highest economic and financial performance in its sector. Moreover, in the second half of 2012, Datalogic will continue to implement the current operating model, resulting from Industrial Automation acquisitions and from the implementation of the new ADC Division. *** The Board of Directors today also approved certain Company By-Laws amendments (within the scope of the Board’s powers at law and under such By-Laws) for the purposes of full compliance with the new statutory provisions introduced by Law n. 120 of 12th July 2011; the text of the amended By-Laws will be published in accordance with applicable legal and regulatory requirements in force. *** The auditing activity for the half-year interim report has not yet been completed and the audit report will be available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit. Lastly, please note that the half-year interim report at 30th June 2012 will be available upon request at the registered office of Datalogic S.p.A. and at the offices of Borsa Italiana S.p.A., and it could also be consulted on the Company’s web site www.datalogic.com (Investor Relations section). The manager responsible for preparing the company’s financial reports - Dott. Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records. Reclassified income statement at 30th June 2012 – Euro/1.000

Reclassified Balance Sheet at 30th June 2012 – Euro/1.000

|