Press Releases

Press Releases

Datalogic (Star: DAL.MI) - Board of Directors approves quarterly financial report at 30 September 2012

|

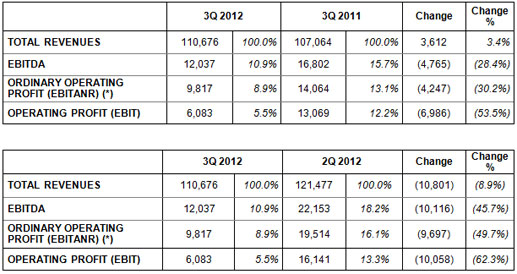

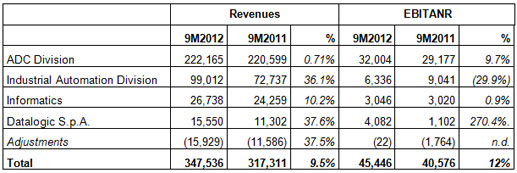

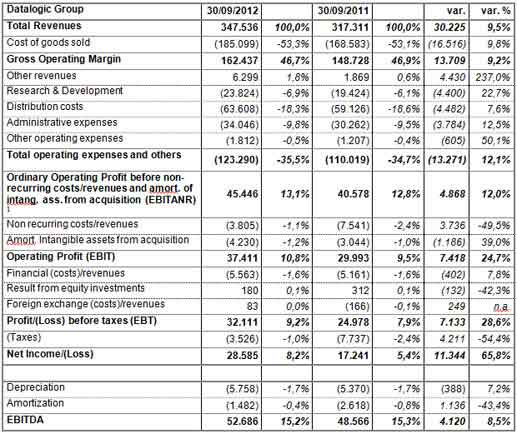

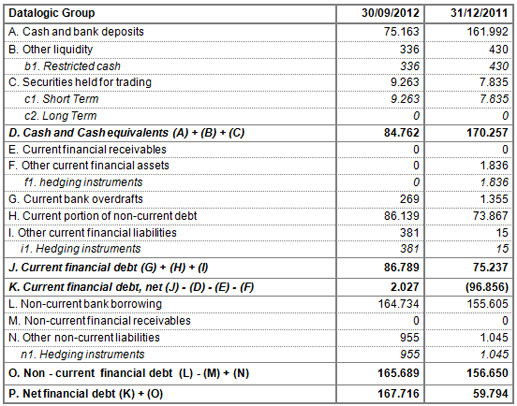

• Sales revenues up 9.5% to €347.5 million, compared to €317.3 million in the first nine months of 2011 Bologna, 12th November 2012 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed on the Star segment of Italy’s electronic stock market (MTA) organised and managed by Borsa Italiana SpA (“Datalogic”), a global leader in Automatic Identification and total solutions provider of bar code readers, data collection mobile computers and vision systems, today approved the Quarterly Financial Report at 30 September 2012. The results for the quarter show a slowdown in activity related to the global macroeconomic crisis. Results for the first nine months of the year, which include Accu-Sort Systems (consolidated from 20 January 2012) and PPT Vision, showed a net profit of €28.6 million, compared to €17.2 million in the same period of 2011. Mauro Sacchetto, CEO of Datalogic Group, commented: “The quarter that has just ended was still influenced by the ongoing international economic and financial crisis, which caused a slowdown in many western countries, affecting the sales of Datalogic and our main competitors. Despite this scenario, Datalogic shows an improvement in the main indicators compared to the first nine months of 2011, both in absolute terms and as a percentage of sales revenues, and managed to outperform the market. Given the upturn in orders for the current quarter and evidence from October, we are confident that the current year will be positive and we will meet our objectives”. Consolidated sales revenues came in at €347.5 million for the first nine months of the year, an increase of 9.5% from €317.3 million in the same period last year. At constant euro/dollar exchange rates, the increase versus the previous year would have been 4.5%. These results include revenues from Accu-Sort Systems and PPT Vision, both integrated into Datalogic Automation from 1 July 2012, totalling €27.9 million. Group EBITDA rose to €52.7 million, from €48.6 million in the first nine months of 2011, while the EBITDA margin was 15.2% in line with the previous year. The margin has begun to benefit from the new supply chain in the ADC segment, created in 2011. EBITANR totalled €45.4 million, compared to €40.6 million in the first nine months of 2011. In the first nine months of the year, the Group registered non-recurring costs of €3.8 million for internal reorganisation, relating to the integration of PPT Vision and Accu-Sort Systems, and the restructuring of the sales structure of the Automatic Data Capture (ADC) division. After financial charges of €5.6 million compared to €5.2 million in 9M 2011, Group net profit grew to €28.6 million, from €17.2 million in the first nine months of 2011. The net financial position on 30 September 2012 was negative at €167.7 million, compared to €59.4 million on 31 December 2011. This was however an improvement on the figure on 30 June 2012 of €171.8 million, thanks to continuous cash generation. The increase from end-2011 was almost entirely due to the acquisition of Accu-Sort Systems in January for €100.3 million. Net working capital was €46 million on 30 September 2012, up from €29.8 million on 31 December 2011. For the third quarter of the year, sales revenues were €110.7 million, up 3.4% on 3Q 2011, but down 8.9% on the previous quarter. This decline was mainly due to a slowdown in the global market and the postponement of some significant projects. The slowdown in revenues was reflected in the margins for the quarter, owing to the greater incidence of fixed costs on sales volumes. EBITDA came in at €12 million, compared to €16.8 million in 3Q 2011, with an EBITDA margin of approximately 11%.

The Group’s new structure, effective as of 1st January 2012, is now organised per relevant market, a necessary step in order to provide integrated solutions at a global level. Therefore, the Group is now structured as follows:

Events in the reporting period (3Q12) The update to the 2012-2014 Business Plan was approved on 27 September 2012. Events after end of reporting period (3Q12) There are no events to report. Outlook for the current year The sector in which Datalogic operates is experiencing a slowdown that is having a negative impact on the results of the main players in the industry: a contraction in revenues has been reported, between 0 and 15 percentage points versus the previous year. We do not see any signs of a consistent recovery in market demand in the short term. In the next quarter and over the next year, Datalogic will continue to pursue the objectives set out in the strategic plan it has just published, focusing on investment in the Automatic Data Capture (ADC) and Industrial Automation (IA) sectors, international expansion in emerging and consolidated markets, R&D, the development of new technologies and the implementation of cutting-edge industrial and logistical processes. *** Furthermore, the Board of Directors of Datalogic SpA resolved today to join the exceptions provided for by Sections 70, paragraph 8, and 71, paragraph 1-bis, of the Issuers’ Regulation (regulation implementing the Consolidated Law on Finance -T.U.F. - concerning the discipline of issuers, adopted by CONSOB under resolution no. 11971 of 14 May 1999, as subsequently amended); therefore, in the event of significant mergers, spin-offs, share capital increase by means of the conferral of assets in kind, takeovers or sales, the Company will no longer be required to prepare and make available to the public the relevant informative documents in compliance with applicable laws and regulations. *** Please note that the Quarterly financial report at 30th September 2012 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com. The manager responsible for preparing the company’s financial reports - Mr Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the Italian Legislative Decree no.58/1998, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th September 2012 – Euro/1.000

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements. [1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

Net Financial Position at 30th September 2012 – Euro/1.000

|