Press Releases

Press Releases

DATALOGIC (Star: DAL.MI) Board of Directors approves interim management statement at 30 September 2011

Best ever quarter in terms of revenues and profitability:

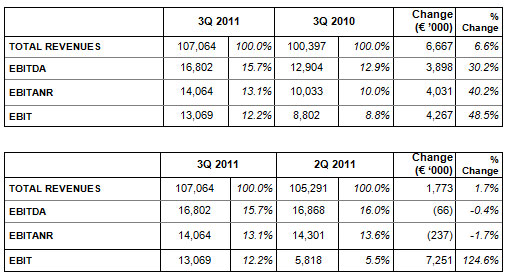

• Sales revenues showed growth of 6.6% to € 107.1 million vs. € 100.4 million in the third quarter of 2010.

• EBITDA grew by 30.2% to € 16.8 million vs. € 12.9 million in the third quarter of 2010, with EBITDA rising to 15.7% from 12.9% in the previous year.

• Net profit surged to € 9.4 million vs. € 3.2 million in the third quarter of 2010.

Strong growth of results in first nine months of 2011:

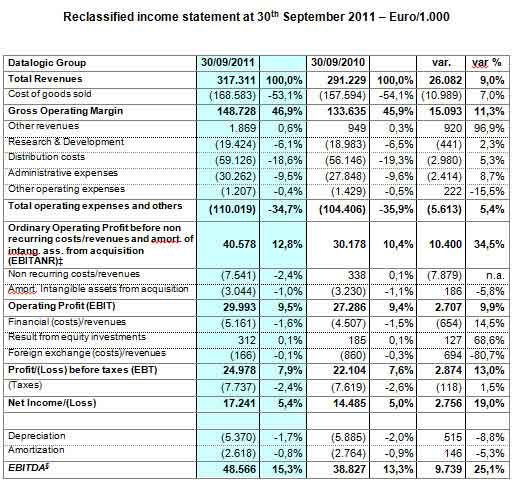

• Sales revenues grew by 9% to € 317.3 million vs. € 291.2 million in the first nine months of 2010.

• Great improvement of EBITDA, which rose to € 48.6 million (+25.1%) vs. € 38.8 million in the first nine months of 2010.

• Net profit rose to € 17.2 million vs. € 14.5 million in the first nine months of 2010, notwithstanding € 9.1 million of extraordinary charges, relating to the new supply chain of the Automatic Data Capture (ADC) segment, expensed in the period.

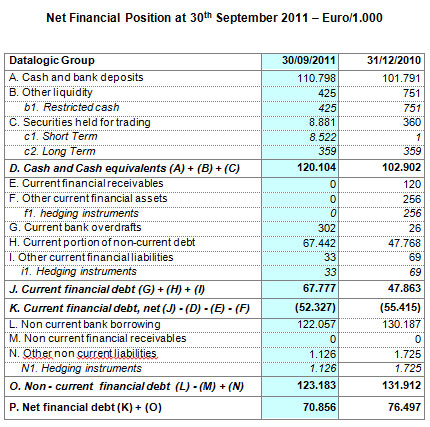

• The negative consolidated NFP improved to € -70.8 million vs. € -76.5 million as at 31 December 2010.

Bologna, 9 November 2011 –Today the Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL) - a company listed in the Star segment of the Milan Stock Exchange (Mercato Telematico Azionario - MTA) organized and managed by Borsa Italiana S.p.A. (“Datalogic”) and leader in the market for barcode readers, mobile computers, RFID and vision systems - approved the Interim Management Statement at 30 September 2011.

The quarterly results confirmed the growth trend and the positive trend of margins.

The first nine months of the year (9M11) ended with net profit of € 17.2 million compared to € 14.5 million reported in the first nine months of 2010 (9M10). The third quarter (3Q11) showed sales revenues of € 107.1 million (+6.6% vs. the third quarter of 2010 (3Q10)) and net profit of € 9.4 million (vs. € 3.2 million in 3Q10).

Mauro Sacchetto, the CEO of Datalogic S.p.A., commented on results as follows: “We’re very pleased with the exceptional performance of this third quarter, a period statistically featuring a so-called seasonality effect that affects results in terms of efficiency and cash generation.

The measures taken in previous quarters and start-up of the new globally integrated supply chain for the Automatic Data Capture segment, for which over 80% of the investment has been expensed in the first nine months, will permit significant recouping of profitability already as from the next financial year. 10 consecutive quarters of growth confirm the Group’s ability to face up to market challenges and to consider a phase of growth and expansion, also via external development”.

Consolidated sales revenues in 9M11 amounted to € 317.3 million with a 9% increase over € 291.2 million in 9M10. At constant EUR/USD exchange rates, the YoY increase would have been about 12%.

Group EBITDA rose to € 48.6 million from € 38.8 million in 9M10 while EBITDA margin progressed to 15.3% vs. 13.3% in 9M10.

EBITANR reached € 40.6 million vs. € 30.2 million in 9M10. The improvement of profitability was even more significant if one considers that, during 9M11, € 1.6 mn of one-shot costs were expense relating to the new supply chain of the ADC segment.

These were joined by € 7.5 million costs of a non-recurring nature, and therefore posted in extraordinary costs, leading to a total of € 9.1 million, accounting for 84% of the total estimated investment of € 10.8 million. These investments have a 1-year payback period and already as from 2012 will permit annual cost savings of € 12.5 million.

After financial charges of € 5.2 million vs. € 4.5 million in 9M10 and foreign exchange losses of € -0.2 million vs. €-0.9 million in 9M10, Group net profit grew to € 17.2 million vs. € 14.5 million achieved in 9M10.

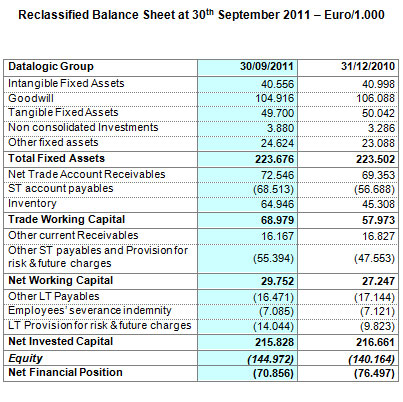

The net financial position at 30 September 2011 showed net debt of € -70.8 million and further improvement vs. € -76.5 million as at 31 December 2010.

Net working capital amounted to € 29.7 million at 30 September 2011 vs. € 27.2 million at 31 December 2010.

At a quarterly level, sales revenues in 3Q11 grew to € 107.1 million (+6.6% vs. 3Q10 and +1.7% vs. the previous quarter (2Q11)) thanks to the commercial strategy and continuous product innovation and despite the seasonal effect that usually penalizes this period of the year.

Operating costs of € 35.9 million showed a reduction of 1.3% vs. 3Q10 and of 1.4% vs. 2Q11. EBITDA thus amounted to € 16.8 million, +30.2% vs. 3Q10, with a 15.7% margin. EBITANR rose by 40.2% to € 14.1 million.

In 3Q11 costs of € 0.6 million were posted for the new supply chain of the ADC segment, of which € 0.5 million among ordinary expenses.

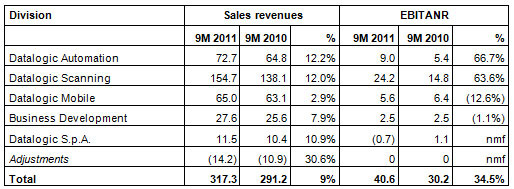

As regards the Group’s operating divisions, all of them reported results featuring very robust growth in 9M11 in terms both of sales revenues and of profitability.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

In the Automatic Data Capture (ADC) segment, the Datalogic Scanning Division – specialized in fixed barcode readers for the retail market and handheld scanners and accounting for nearly 49% of consolidated sales - grew by 12.0% in terms of sales revenue and by 52% in terms of EBITDA, which totalled € 27.2 million.

The Datalogic Mobile Division - specialized in the production of mobile computers for professional use and accounting for 20% of consolidated sales – featured an increase of 2.9% in terms of sales revenues while EBITDA amounted to € 7.3 million (-10.1% vs.9M10).

Datalogic Automation – which specializes in the production of automatic identification systems, safety, detection and marking solution for the Industrial Automation market and accounting for 23% of consolidated sales – featured an increase of 12.2% in sales revenue and of 41% in terms of EBITDA, which totalled € 11 million.

The Business Development Division - which comprises the companies Informatics and Evolution Robotics Retail Inc. and accounts for 9% of consolidated sales – showed an increase in sales revenues of about 8% (€ 27.6 millions) and EBITDA stablwe at € 2.7 million.

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR by segment in 9M11.

The Datalogic Mobile Division - specialized in the production of mobile computers for professional use and accounting for 20% of consolidated sales – featured an increase of 2.9% in terms of sales revenues while EBITDA amounted to € 7.3 million (-10.1% vs.9M10).

Datalogic Automation – which specializes in the production of automatic identification systems, safety, detection and marking solution for the Industrial Automation market and accounting for 23% of consolidated sales – featured an increase of 12.2% in sales revenue and of 41% in terms of EBITDA, which totalled € 11 million.

The Business Development Division - which comprises the companies Informatics and Evolution Robotics Retail Inc. and accounts for 9% of consolidated sales – showed an increase in sales revenues of about 8% (€ 27.6 millions) and EBITDA stablwe at € 2.7 million.

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR by segment in 9M11.

As regards geographical areas, growth continued to be significant of sales going to emerging markets, headed by South America, included in the RoW grouping which grew by 11% vs. 9M10 (increasing from € 24.6 million to € 27.4 million). North America grew by 10%, rising from € 84.5 million to € 93.2 million. There was a significant increase in Italy, with sales growing by 11% to € 34.3 million, while in Europe they rose by 8%, increasing from € 114.9 million to € 124.5 million.

Events in the reporting period

There were no events to report.

Events after end of reporting period

On 20 October 2011 Datalogic placed 2,000,000 of its treasury shares, accounting for about 3.4% of share capital, via an accelerated bookbuilding procedure targeting only institutional investors.

Please note that the Interim Management Statement at 30 September 2011 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports - Dott. Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

[§] EBITDA - Earnings before interest, taxes, depreciation and amortization