|

• 4Q13 strong recovery compared to the previous year both in terms of revenues (+5%) and EBITDA (+60%)

• Sales revenues at 450.7 million Euro compared to 462.3 million Euro of the previous year

• EBITDA totalled 60 million Euro compared to 63.2 million Euro in 2012 (despite a growth of R&D costs of 3.6 million Euro), EBITDA margin at 13.3%

• Net profit came to 26.9 million Euro compared to 10.2 million Euro of the previous year

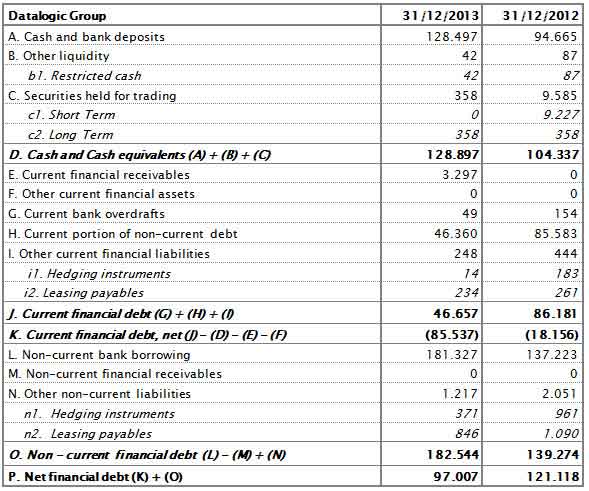

• Net financial debt strongly improved at 97 million Euro compared to 121.1 million Euro at 31st December 2012

• Proposed a dividend of 16 eurocents per share with a growth of +7% compared to 2012

Bologna, 6th March 2014 - The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the draft financial statements for the parent company and the consolidated financial statements at 31st December 2013.

Performance was mixed in 2013. The macroeconomic situation made for a slow first half, but growth improved in the second half of the year as demand gradually picked up in all key sectors. Despite continued uncertainties surrounding when major investment will resume, the retail sector in particular began to show signs of a recovery, driven in part by the launch of new cutting-edge products. Revenues came in at 450.7 million Euro compared to 462.3 million Euro in 2012, while EBITDA totalled 60 million Euro with a decline of 5.0% against 2012 (63.2 million Euro), bringing the EBITDA margin to 13.3%. The Group closed the year with a consolidated net profit of 26.9 million Euro compared to 10.2 million Euro in 20121.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: "We are happy with the annual results, which demonstrate that our key markets have remained stable and also confirm that products launched during the year were well received by our customers. The Group made some major changes in 2013. We created the new Business Development division, with a view to securing the future of the Datalogic Group as an Italian high-tech group operating on the world market; the division seeks to listen to customers, to manage core technologies and develop innovative products. Other key posts have also been created, notably the new HR manager, with the aim of improving staff satisfaction and HR management within the Group. Lastly, we have boosted investment in high-growth countries. I am deeply convinced that these measures are essential to ensuring that Datalogic can maintain growth in an increasingly competitive environment. The recovery observed at the end of 2013 and in early 2014 gives us grounds for optimism about the Group's performance in 2014."

Note that the figures as at 31st December 2012, included for comparison purposes, have been restated to reflect the application of IAS 19R, which has improved consolidated profit for 2012 from 9.9 million Euro to 10.2 million Euro (up 2.2%).

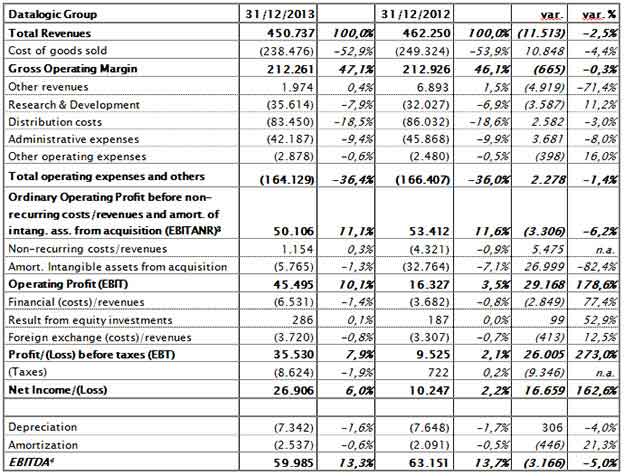

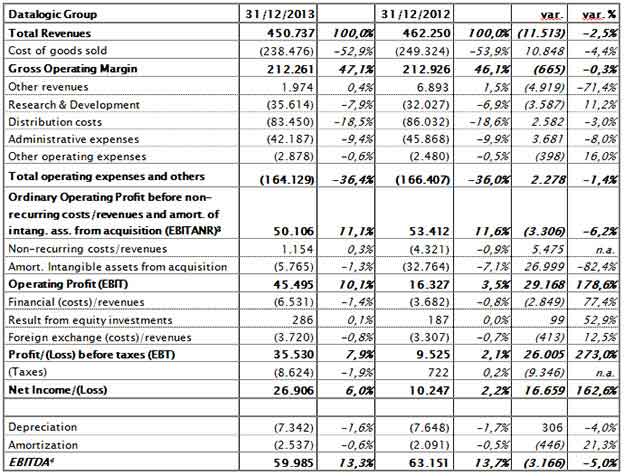

In 2013, sales revenues came in at 450.7 million Euro, a drop of 2.5% compared to 462.3 million Euro reported in 2012. Revenues were dented by the weak US dollar: at constant Euro/Dollar exchange rate revenues should have been stable.

At 212.3 million Euro, gross operating margin was essentially in line with 2012 (-0.3%), while the 47.1% EBITDA margin advanced one percentage point.

Operating costs came in at 164.1 million Euro, down 1.4% compared to 166.4 million Euro despite higher research and development costs, which accounted for 7.9% of revenues (2012: 6.9%), as the Group gradually intensified the focus on development and innovation.

EBITDA came to 60 million Euro, down 5% year-on-year compared to 63.2 million Euro in 2012, with an EBITDA margin at 13.3% compared to 13.7% of the previous year. It should be noted that the 2012 figures included one-off costs for M&A activities amounting to 2.2 million Euro and 5.5 million Euro in revenues related to the sale of some assets, such as patents, expertise and other intangible fixed assets related to a non-core business of the Group.

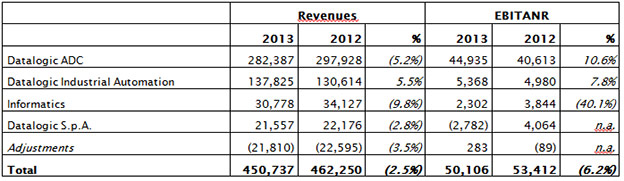

EBITANR2 came in at 50.1 million Euro, down 6.2% from 53.4 million Euro in 2012.

Operating result (EBIT), that in 2012 was affected by a write off due to impairment test results arising from goodwill on Accu-Sort Systems Inc. totalling 27 million Euro, rose from 16.3 million Euro in 2012 to 45.5 million Euro in 2013.

Financial costs totalled 6.5 million Euro compared to 3.7 million Euro in 2012, while foreign exchange costs came to 3.7 million Euro compared to 3.3 million Euro of the previous year.

Group net profit came in at 26.9 million Euro compared to 10.2 million Euro in 2012.

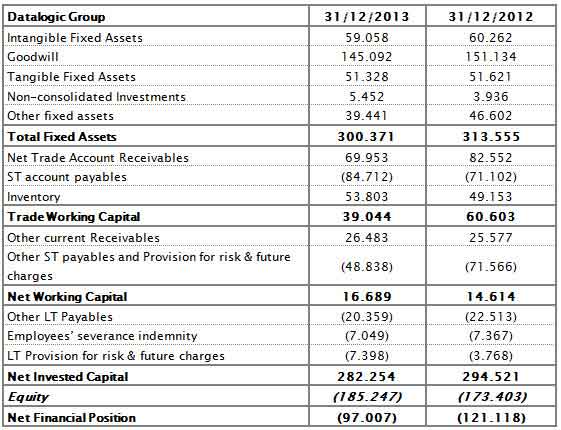

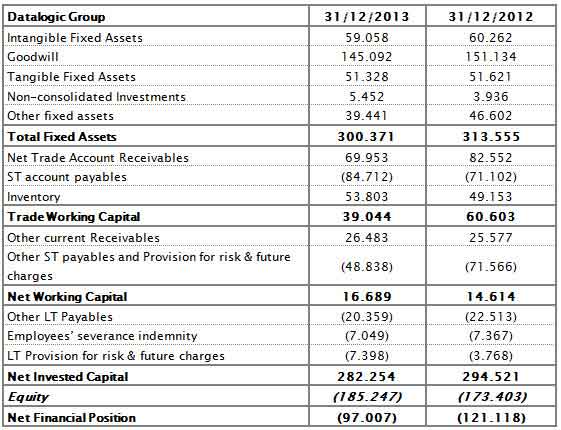

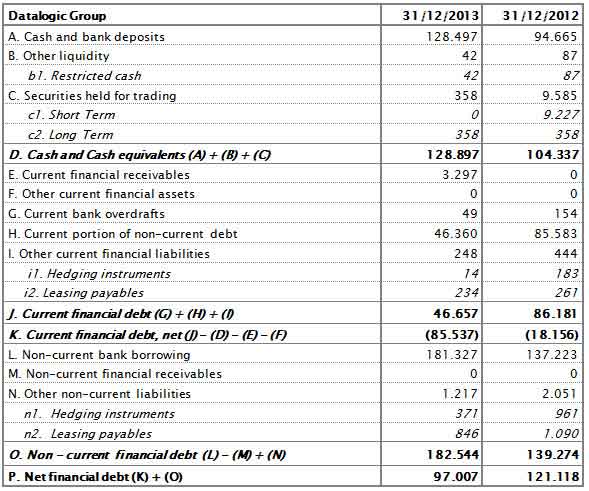

As at 31st December 2013, net financial debt had improved significantly, declining to 97.0 million Euro as a result of consistently strong cash generation (from 121.1 million Euro at the end of 2012 and 113.4 million Euro at 30th June 2013).

As at 31st December 2013, net working capital had increased to 16.7 million Euro compared to 14.6 million Euro at 31st December 2012.

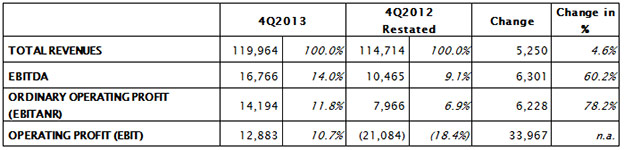

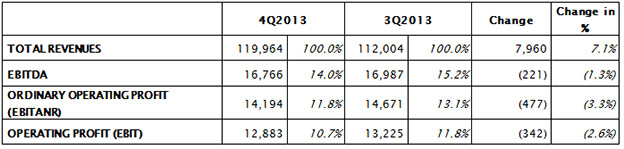

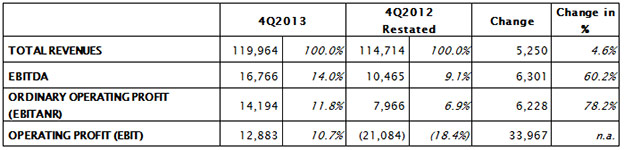

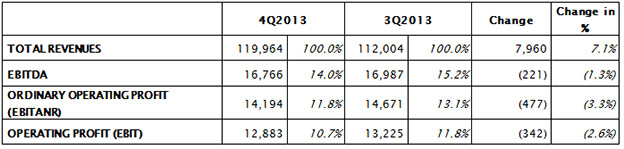

PERFORMANCE IN FOURTH QUARTER 2013

There were clear signs of recovery in the fourth quarter of 2013 as compared to the previous quarter, with revenue climbing to 119.9 million Euro (up 7.1% against third quarter 2013 and up 4.6% against fourth quarter 2012). EBITDA showed a positive performance compared to the fourth quarter of 2012 (+60.2%) while it was substantially consistent with third quarter performance.

[2] EBITANR – Earnings before interest, taxes, acquisition and non recurring

The orders already received during the quarter came to 119 million Euro.

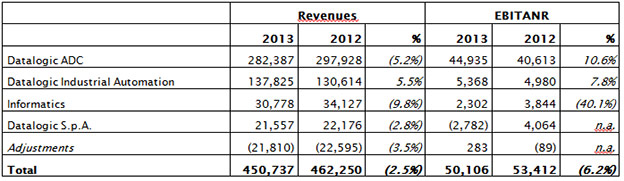

PERFORMANCE BY DIVISION

The ADC Division (Automatic Data Capture) specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, reported sales revenues totalling 282.4 million Euro (2012: 297.9 million Euro). In the fourth quarter of 2013, divisional revenues came to 79.5 million Euro, up 16.4% compared to 68.3 million Euro in the third quarter of 2013. The rise reflected the initial benefits of new product launches during the year – notably in the fixed scanner segment – and a widespread recovery in the US market.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, recorded sales revenues of 137.8 million Euro, up 5.5% compared to 130.6 million Euro in 2012. Sales in the fourth quarter of 2013 came to 32.9 million Euro, down 8.4% compared to 35.9 million Euro in the third quarter of 2013 due to reduced revenue contributions from the transportation and logistics segment.

At the end, Informatics reported sales revenues totalling 30.8 million Euro, down from 34.1 million Euro in 2012.

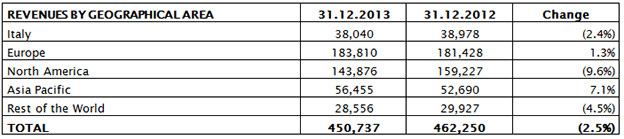

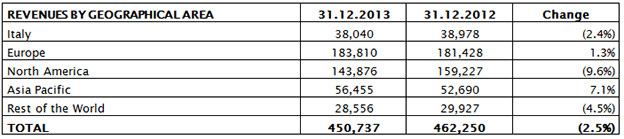

REVENUES BY GEOGRAPHIC AREA

The European market experienced a turnaround, reporting growth at 1.3%, while the North American market declined a further 9.6%. The emerging Asia Pacific markets advanced 7.1%.

EVENTS DURING THE YEAR

In the month of February, CEO Mauro Sacchetto resigned. The position was taken over by Romano Volta, formerly the Company Chairman.

In June, the company received a mid-term pool loan for 110 million Euro. The loan has a duration of five years with the covenants broadly in line with those of similar loans taken out by the Group.

The Business Development Division was created, with a view to meeting current and future demand in key markets by developing new products and coordinating R&D investment. The Business Development Division includes three main units:

- New needs and application scouting

- Datalogic LABS

- Mergers & Acquisitions.

On 1st August an agreement was signed for the acquisition of the assets and the high power pulsed fibre laser technology based on the advanced “MOPA” system from Multiwave Photonics S.A., a Portuguese company based in Porto.

The update of the 2013-2015 Business Plan was presented in September.

On 18th November, Datalogic SpA signed a strategic agreement with the Japanese IDEC Corporation for the development of the Japanese market.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

Both 2012 and 2013 were characterised by stagnation in the key markets for our products, which were affected by weak growth in the leading global economies.

We anticipate that the key markets will recover in 2014, which should benefit the two main operating divisions, ADC and Industrial Automation. The divisions should be able to build on past and current major investments by improving product ranges and increasing market share in fast-growing markets, notably China and Brazil.

At the Shareholders’ meeting scheduled for 23rd April 2014, the Board of Directors will propose the payout of an ordinary dividend, gross of legal withholdings, of 16 eurocents per share (increased compared to 15 eurocents per share for 2012) for a maximum amount of 9.4 million Euro (record date of 14th May) and payment date from 15th May 2014.

The Board of Directors also approved the Annual Corporate Governance Report. A copy of the report will be made available to the public in accordance with applicable law.

Note that the auditing of the draft financial statements has not yet been completed and that the independent auditors’ report will be made available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Finally, the Annual Financial Report (pursuant to article 154-ter of the Testo Unico della Finanza - TUF) of Datalogic S.p.A. will be made available to anyone who requests it at the company headquarters or at Borsa Italiana SpA, and may also be consulted on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations.

The manager responsible for preparing the company’s financial reports - Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st December 2013 – Euro/1.000

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[3] EBITANR – Earnings before interest, taxes, acquisition and non recurring

[4] EBITDA - Earnings before interest, taxes, depreciation and amortization

Reclassified Balance Sheet at 31st December 2013 – Euro/1.000

Net Financial Position at 31st December 2013 – Euro/1.000

|