|

• Sales revenues at 340.1 million Euro, +2.8% compared to 330.8 million Euro in the first nine months of 2013

• Margin growth continues: EBITDA at 52.0million Euro, +20,3% compared to 43.2 million Euro in the first nine months of 2013, EBITDA margin at 15.3%

• Net profit at 25.7 million Euro compared to 17.7 million Euro in the first nine months of 2013

• Consolidated net financial debt continues to improve at 81.7 million Euro compared to 97.0 million Euro at 31st December 2013

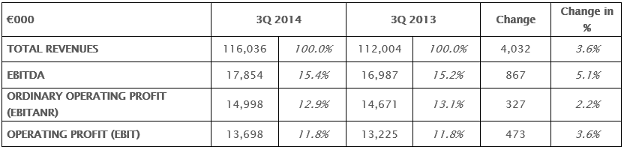

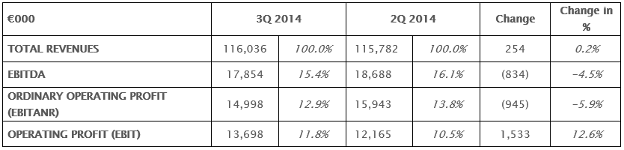

• All the economic indicators continue to improve in Q3: Revenues +3.6% YoY at 116.0 million Euro, EBITDA +5.1% at 17.8 million Euro, EBIT +3.6% at 13.7 million Euro and net profit +40.7% at 10.4 million Euro

Bologna, 7th November 2014 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the Quarterly Financial Report at 30th September 2014.

Economic indicators continued to improve in the third quarter notwithstanding the seasonal effect that is typical of this time of the year, and thanks to the positive trend of the ADC market that was piloted by investments in the retail segment. A new General Manager was appointed for the Americas for the IA division.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: “We are certainly satisfied with the results of the quarter which showed the best net result for a quarter in the last two years and which highlight a positive trend in terms of sales and, above all, margins. Excellent results worthy of note were achieved by the ADC segment thanks to the introduction of new products in all the reference markets. On the other hand, there are high expectations for a recovery of the Industrial Automation division following the introduction of new professional profiles and a step-up of R&D activities. The positive results of this quarter lead us to expect that closure of the financial year should be in line with expectations, a further demonstration of the effectiveness of the strategic decisions made in the latter period”.

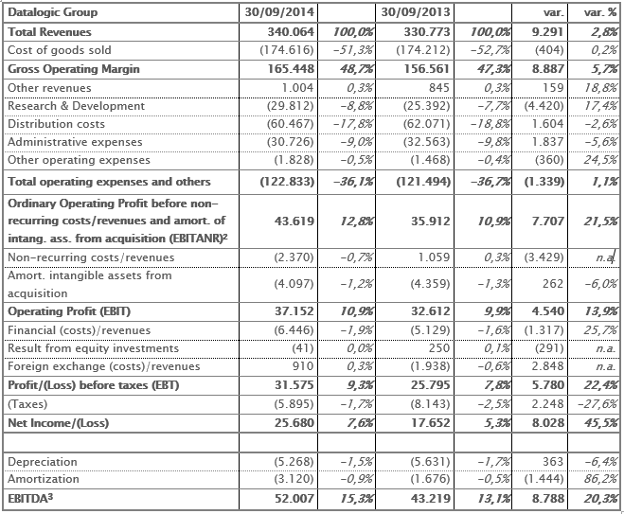

Consolidated sales revenues for the first nine months of 2014 came in at 340.1 million Euro, +2.8% compared to 330.8 million Euro in the same period of the preceding year. At constant Euro/Dollar exchange rate the increase versus the previous year would have been 4.2%. The booking during the quarter – the orders already received - was equal to 116.3 million Euro.

Gross operating margin came in at 165.4 million Euro, +5.7% compared to 156.6 million Euro in the same period of the preceding year, up 1.4 points as a percentage of total revenues, from 47.3% to 48.7%. The improvement of the gross operating margin was mainly attributable to a reduction in the cost of materials, to a more favourable sales mix and a good performance of average selling prices.

Group EBITDA increased by 20.3% from 52.0 million Euro compared to 43.2 million Euro in the first nine months of 2013, with an EBITDA margin from 13.1% to 15.3%. General & Administrative expenses fell by 5.6% to 30.7 million Euro on the back of cost-cutting measures.

Investment in Research & Development continued to rise, both in absolute terms, from 25.4 million Euro in the first nine months of 2013 to 29.8 million Euro (+17.4%), and as a percentage of revenues, from 7.7% to 8.8%. This confirms the importance of the focus on innovation technology and product.

EBITANR came in at 43.6 million Euro up by 21.5% compared to 35.9 million Euro in the first nine months of 2013.

After non-recurring costs of 2.4 million Euro (1.0 million Euro of non-recurring revenues in the first nine months of 2013) mainly due to reorganization costs of Industrial Automation division, EBIT shows a growth of 13.9% from 32.6 million Euro to 37.1 million Eur. After financial charges of 6.4 million Euro compared to 5.1 million Euro in the first nine months of 2013 and foreign exchange revenues for 0.9 million Euro compared to foreign exchange costs for 1.9 million Euro in the first nine months of 2013, Group net profit came at 25.7 million Euro compared to 17.7 million Euro realized in the same period of the preceding year.

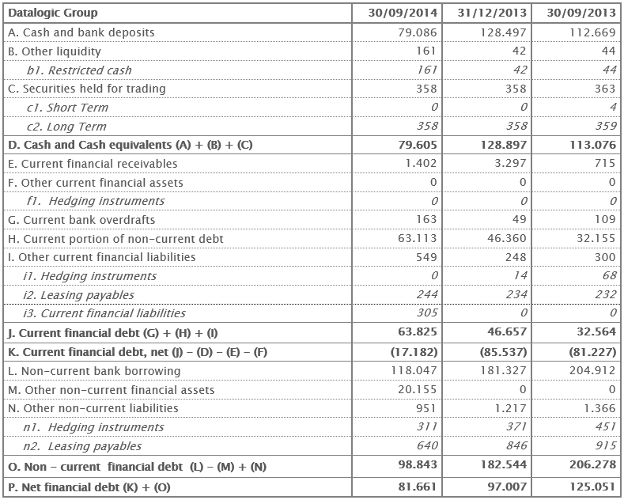

The net financial position on 30th September 2014 was negative at 81.7 million Euro, significantly improved compared to 97.0 million Euro at 31st December 2013 and 86.0 million Euro on 30th June 2014 thanks to the continuous cash generation.

QUARTERLY TREND

Results for the third quarter of 2014 show a net improvement compared to the third quarter of 2013: the sales revenues totalled 116.0 million Euro (+0.2% compared to the previous quarter and +3.6% compared to the third quarter of 2013), the EBITDA totalled 17.8 million Euro (-4.5% compared to the second quarter of 2014 and +5.1% compared to the third quarter of 2013) and the EBITANR totalled 15.0 million Euro (-5.9% compared to the second quarter of 2014 and +2.2% compared to the third quarter of 2013).

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

Comparison between third quarter 2014 and third quarter 2014

Comparison between third quarter 2014 and second quarter 2014

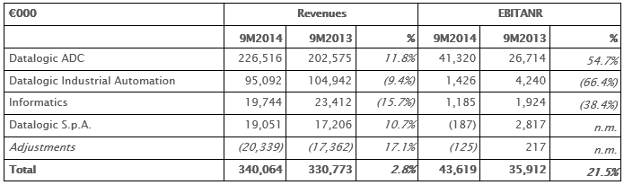

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) for the first nine months of 2014 for the individual Operating Divisions.

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, registered revenues of 226.5 million Euro up by +11.8% compared to 202.6 million Euro in the first nine months of 2013. Sales revenues for the third quarter of 2014 came in at 77.4 million Euro in line with the second quarter of 2014 and up by +13.1% compared to the third quarter of 2013. The division continues to drive growth on the back of the success registered by the introduction of new technologically-advanced products and the hiring of new salespeople, particularly in Europe.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, registered revenues of 95.1 million Euro in the first nine months of 2014, down by -9.4% compared to 104.9 million Euro in the first nine months of 2013. The division booked a recovery of 0.97% compared to the previous quarter, showing revenues of 32.5 million Euro and reduced the year-on-year decline (-9.6% versus the third quarter of 2013) thanks to a positive performance in EMEA and APAC while the ongoing negative trend in the US is mainly due to a fall in projects in the postal segment.

Finally Informatics registered sales of 19.7 million Euro compared to 23.4 million Euro in the first nine months of 2013. In the third quarter of 2014 sales came in at 6.7 million Euro compared to 6.9 million Euro in the second quarter of 2014 and 7.8 million Euro in the third quarter of 2013. In the second quarter of the year, a new General Manager was appointed with a 10-year experience in automatic identification sector and software solutions for retail.

With regard to geographical regions, in the first nine months of 2014 the European market registered an 11.3% growth reaching 177.9 million Euro, followed by ROW countries (including Latin America) with 10.9% growth. The North American market is contracting at the rate of 8.6%, mainly due to the trend of the Industrial Automation division, while Asia Pacific fell by 3.9%. Within the Asia Pacific region it is worth noting a growth in excess of 7% in the Greater China area.

PERIOD EVENTS

Effective 30th June 2014, Valentina Volta, member of the Board of Director of Datalogic S.p.A., has been appointed Chief Executive Officer of the Industrial Automation division.

From September 1st, a new General Manager was appointed for the Americas, with more than ten years’ experience in the sector.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

Significant investment in Research and Development continues; in particular the Business Development division, an effective dynamic cross organisation, has systematically fused the group's approach of making innovation the essential driver for growth and the creation of value into a fundamental building block of Datalogic's future.

Once again the results confirm, or rather strengthen the positive trend that started in the second half of 2013 above all for the ADC division. Also taking into account the positive booking trend for the quarter, it is expected that Q4 2014 will be in line with the positive performance achieved in the preceding quarters.

***

In today's meeting, the Board of Directors also resolved to adopt the Italian Stock Exchange Code of Self-discipline as updated in July 2014.

Please note that the Interim Management Statement at 31st March 2014 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports - Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th September 2014 – Euro/1.000

Note: In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[2] EBITANR – Earnings before interest, taxes, acquisition and non recurring.

[3] EBITDA - Earnings before interest, taxes, depreciation and amortization.

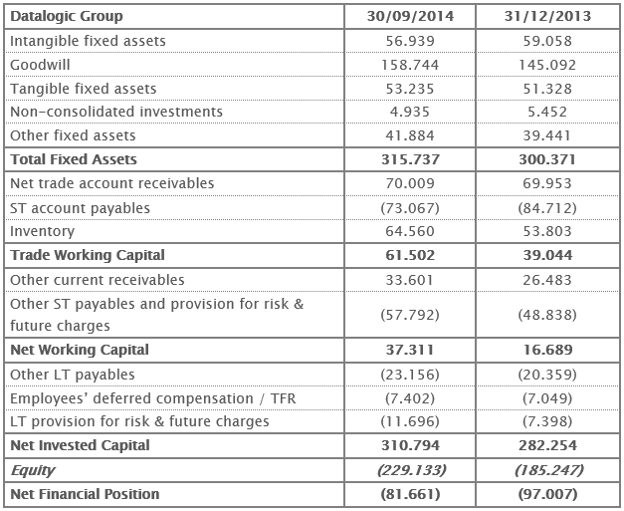

Reclassified Balance Sheet at 30th September 2014 – Euro/1.000

Net Financial Position at 30th September 2014 – Euro/1.000

|