Press Releases

Press Releases

Datalogic (Star: DAL) - Half-year report at 30th June 2014 approved by Board of Directors

|

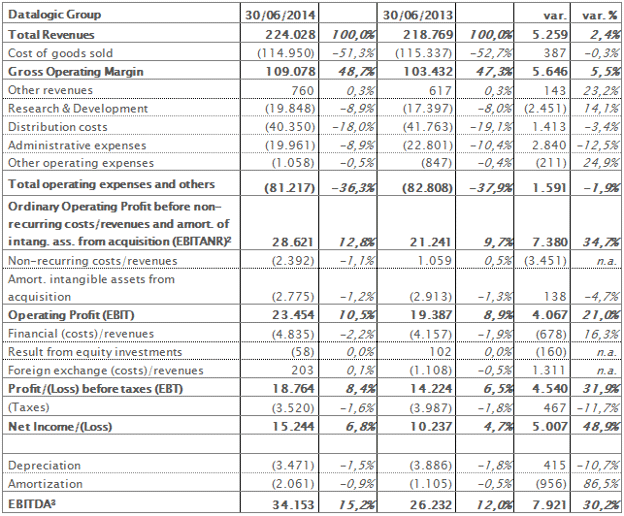

• Consolidated net financial debt improved at 86.0 million Euro compared to 97.0 million Euro at 31st December 2013 The results for the first half, which closed with a growth of +30.2% of the EBITDA at 34.2 million Euro and a growth of +48.97% of the net profit at 15.2 million Euro, confirm the positive trend, particularly in the ADC segment, and testify the Group’s capacity to increase its operating margin despite lower growth in sales revenues and increasing investment in Research & Development. The Chairman and CEO of the Datalogic Group, Romano Volta, commented: “The positive results achieved in the first half of the year in all indicators confirm the Group’s capacity to anticipate the market’s needs and its success in making internal processes more efficient. A clear example of this is the products launched in 2013, particularly in the retail segment, which continue to do well on all core markets, especially in Europe. The Group also performed very well in high-growth markets such as China and Latin America, thanks to ongoing investment in both production – e.g. the recent opening in Brazil – and marketing. For the Industrial Automation division, there was a slight recovery from the previous quarter, although the trend in sales remains unsatisfactory, particularly in North America. We are convinced that a review of the market strategy, with particular focus in North America, will allow to take the numerous business opportunities that our product range can offer. Note, finally, the growth in absolute terms and as a percentage of revenues in investment in Research & Development, a key factor in the long-term growth of the business”. Consolidated sales revenues for the first half of 2014 came in at 224.0 million Euro, +2.4% compared to 218.8 million Euro in the same period of the preceding year. At constant Euro/Dollar exchange rate the increase versus the previous year would have been 4.5%. The booking during the quarter – the orders already received - was equal to 116.3 million Euro. Gross operating margin came in at 109.1 million Euro, +5.5% compared to 103.4 million Euro in the same period of the preceding year, up 1.4 points as a percentage of total revenues, from 47.3% to 48.7%. Group EBITDA increased by 30.2% from 34.2 million Euro compared to 26.2 million Euro in the first half of 2013, with an EBITDA margin from 12% to 15.2%. General & Administrative expenses fell by 12.5% to 20 million Euro on the back of cost-cutting measures. Investment in Research & Development continued to rise, both in absolute terms, from 17.4 million Euro in the first half of 2013 to 19.8 million Euro, and as a percentage of revenues, from 8.0% to 8.9%. This confirms the importance of these costs for the development and the growth of the activities. EBITANR[1] came in at 28.6 million Euro up by 34.7% compared to 21.2 million Euro in the first half of 2013. After non-recurring costs of 2.4 million Euro (1.0 million Euro of non-recurring revenues in the first half of 2013) mainly due to reorganization costs of Industrial Automation division, EBIT shows a growth of 21% from 19.4 million Euro to 23.5 million Euro. After financial charges of 4.8 million Euro compared to 4.2 million Euro in the first half of 2013 and foreign exchange revenues for 0.2 million Euro compared to foreign exchange costs for 1.1 million Euro in the first half of 2013, Group net profit came at 15.2 million Euro compared to 10.2 million Euro realized in the same period of the preceding year. The net financial position on 30th June 2014 was negative at 86.0 million Euro, significantly improved compared to 97.0 million Euro at 31st December 2013 and 97.4 million Euro on 31st March 2014 thanks to the continuous cash generation. Trade working capital was 54.9 million Euro at 30th June 2014 up from 39.0 million Euro on 31st December 2013.

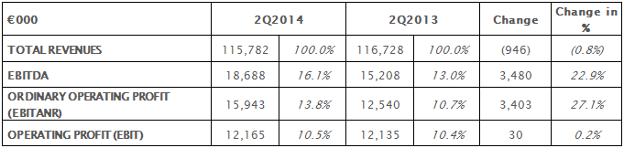

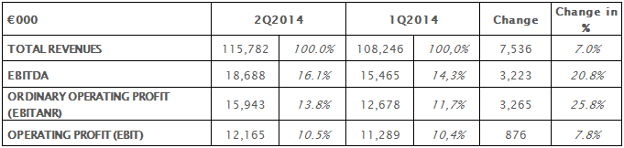

QUARTERLY TREND

Comparison between second quarter 2014 and second quarter 2013

Comparison between second quarter 2014 and first quarter 2014

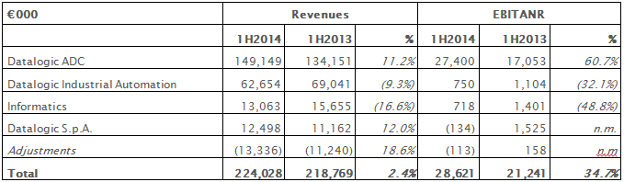

PERFORMANCE BY DIVISION The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) for the first half of 2014 for the individual Operating Divisions. The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, registered revenues of 149.1 million Euro, up +11.2% compared to 134.2 million Euro in the first half 2013. This division has benefited from a positive trend across all the business lines, due to the launch of highly innovative products in the retail segment and throughout all the geographical regions. This has occurred thanks to a closer management of the territory and a new channel programme.

*** The auditing activity for the half-year interim report has not yet been completed and the audit report will be available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit. The manager responsible for preparing the company’s financial reports - Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th June 2014 – Euro/1.000

Note: In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements. [2] EBITANR – Earnings before interest, taxes, acquisition and non recurring.

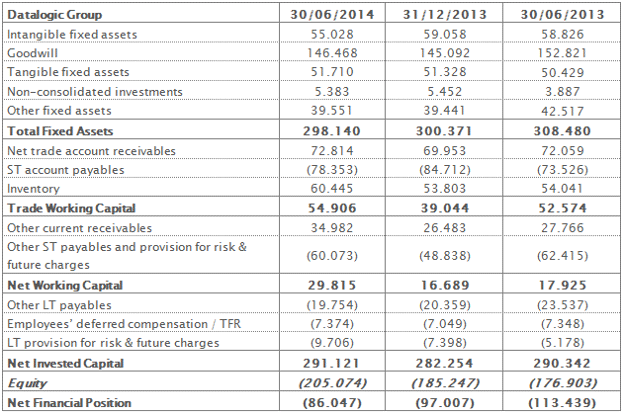

Reclassified Balance Sheet at 30th June 2014 – Euro/1.000

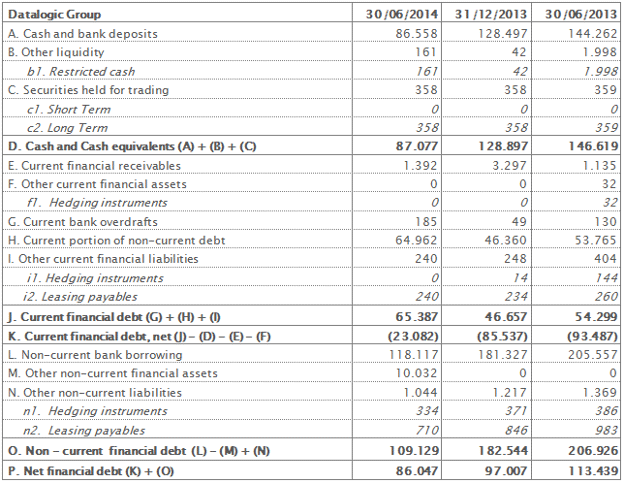

Net Financial Position at 30th June 2014 – Euro/1.000

|