Press Releases

Press Releases

The Board of Directors approves Draft Statutory and Consolidated Financial Statements as at 31 December 2018

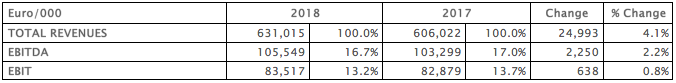

CONSOLIDATED REVENUES UP 4.1% TO €631.0 MILLION

(+6.4% AT CONSTANT EXCHANGE RATES)

CONSOLIDATED EBITDA AT €105.5 MILLION (+2.2%)

EBITDA MARGIN AT 16.7%

CONSOLIDATED NET PROFIT UP TO €62.2 MILLION (+3.5%)

NET FINANCIAL POSITION POSITIVE AT €23.8 MILLION

- Consolidated revenues at €631.0 million, up 4.1% from €606.0 million in 2017 (+6.4% at constant exchange rates). In Q4 Revenues at €164.9 million, a record high for Datalogic, up 6.2% on Q4 2017

- EBITDA at €105.5 million, up 2.2% from €103.3 million in 2017 (EBITDA margin at 16.7% compared to 17.0% in 2017)

- Net profit at €62.2 million, up 3.5% from last year’s €60.1 million

- Net financial position positive at €23.8 million vs €30.1 million at 31 December 2017

- Board of Directors proposes the Shareholders' Meeting pay a dividend, before legal withholdings, of 50 euro cents per share, in line with last year

Bologna, 19 March 2019 - The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and process automation markets, has approved the draft statutory and consolidated financial statements as of 31 December 2018.

The Chief Executive Officer of the Datalogic Group, Valentina Volta, commented: “Once again, 2018 has seen the Group successfully confirm growth in revenues thanks to the outstanding performance of the US market, driven by the Retail and Transportation & Logistics sectors that grew double digit, as well as Manufacturing and the excellent results seen on the Chinese market, driven by Manufacturing.

The extremely positive performance by these two geographic areas was partially offset by a slowing in the EMEA area and in Italy in particular.

2018 was a record year for the Group in terms of investments in Research and Development and the strengthening of the commercial and distribution structures, with a rise of almost €20 million on 2017. We expect to see major benefits in terms of new product development and increased sales in the next few years, particularly in North America thanks to these investments. The Group has managed to maintain a level of profitability substantially in line with 2017, despite the higher investments, through the improvement of the Gross Margin and action taken to control and limit general and administrative expenses.

We are confident we can continue our growth in revenues well into 2019, maintaining our profitability despite a year start showing some uncertainty in Europe and Asia.”

2018 PERFORMANCE

Results for FY 2018 show an increase in all financial indicators, confirming the positive trend seen in recent years and once again booking the best ever performance since the year during which the Group was founded. Although benefiting from an improvement to the gross operating margin, the economic indicators reflect the greater investments made in R&D and the strengthening of the commercial organisations necessary to pursue the Group’s growth.

Consolidated net revenues were €631.0 million and, despite an unfavourable trend in exchange rates, recorded growth of 4.1% on the €606.0 million booked in 2017 (+6.4% at constant exchange rates), above all thanks to an improved mix.

The gross operating margin at €306.0 million, has grown by 6.1% on the €288.4 million booked the previous year, also showing a 0.9 percentage points increase in the incidence on revenues, going from 47.6% in 2017 to 48.5% in 2018. The improvement is mainly due to efficiencies on the purchase of materials and the control of fixed production costs.

Operating and other costs at €215.6 million, are up 7.9% on the €199.8 million booked in 2017 and increase by 1.2 percentage points in terms of incidence on turnover, going from 33.0% to 34.2%. This increase is primarily due to a rise in research and development costs (+12%) and distribution costs (+12.6%), partially offset by the reduction in administrative and general expenses.

Research and Development costs total € 61.9 million, accounting for 9.8% of revenues as compared with the 9.1% recorded in 2017. Distribution costs came to €112.2 million, with an incidence of 17.8% on revenues as compared with the 16.5% booked in 2017, following Group investments made during the period, in the distribution and sales network.

Administrative and general expenses came to €43.2 million, down on the €44.8 million booked in 2017, thanks to constant action taken to limit costs, with an incidence on revenues that drops to 6.8% from 7.4% in 2017.

EBITDA of €105.5 million rose by 2.2% on the 103.3 million recorded in 2017 (+1.4% at constant exchange rates), whilst the incidence on revenues (EBITDA margin) went from 17.0% in 2017 to 16.7% in 2018, primarily due to the above-described greater investments made in R&D and the strengthening of the commercial organisations, partially offset by an improvement in the gross operating margin and a limiting of administrative and general expenses.

EBIT increased by 0.8%, going from €82.9 million to €83.5 million, whilst the incidence on revenues went from 13.7% in 2017 to 13.2% in 2018.

Non-recurring costs/revenues and impairment (€2.3 million vs €0.9 million in 2017) mainly related to the reorganisation of the industrial and distribution footprint and to restructuring operations involving various company departments.

Financial income was negative by €5.7 million, as compared with a negative €7.3 million in 2017. The improvement is mainly due to the benefits of the renegotiation of the cost of loans and the reduction of bank expenses and trade exchange differences recorded on exposures in foreign currencies.

The Group’s net profit was €62.2 million, up 3.5% on the profit booked the previous financial year, of €60.1 million. Incidence on revenues was 9.9%, in line with 2017.

At 31 December 2018, the net financial position was positive for €23.8 million, down €6.3 million on 31 December 2017 (when it was positive for €30.1 million). Net of treasury share purchases for €16.9 million and the distribution of dividends for €28.9 million, period cash generation deriving from the business is positive for €39.5 million.

Trade working capital at 31 December 2018 was €69.1 million, up €7.6 million on 31 December 2017, accounting for 11.0% of revenues, up on December 2017 (10.1%), mainly due to the increase in inventories.

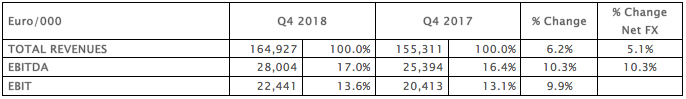

QUARTERLY PERFORMANCE

Comparison between Q4 2018 and Q4 2017

Total revenues in the fourth quarter of 2018 came in at €164.9 million, up 6.2% on the fourth quarter of 2017 (+5.1% at constant exchange rates).

Fourth quarter EBITDA rose by 10.3%. The incidence on revenues came in at 17.0% (16.4% in the fourth quarter of 2017).

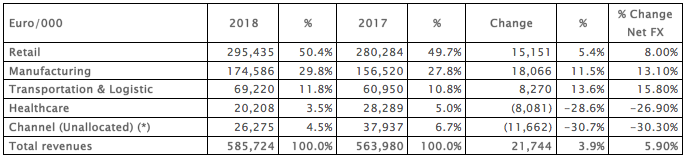

2018 PERFORMANCE BY DIVISION

In 2018, the Datalogic Division recorded turnover of €585.7 million, up 3.9% on 2017 (+5.9% at constant exchange rates), showing a particularly positive performance in North America, where growth of 15.6% on the previous year was recorded (+20% at constant exchange rates) and in APAC, especially in China, which recorded growth of 13.9% (+16.7% at constant exchange rates).

Division EBITDA amounted to €102.1 million, up 1.9%, with an incidence on turnover of 17.4% (17.8% in 2017).

Below are details of Datalogic Division revenues, broken down by business segment:

(*) The Channel (Unallocated) segment includes revenues that cannot be directly attributed to the 4 identified segments.

Please note that 2017 data has been reclassified.

The Retail sector books an increase of 5.4% on last year (+8.0% at constant exchange rates), thanks to solid growth in North America (35.1%; +40.2% at constant exchange rates), which more than offset the 5.3% reduction in EMEA (-4.5% at constant exchange rates) and other geographic areas.

The Manufacturing sector continued to expand, with growth of 11.5% on last year (+13.1% at constant exchange rates), mainly driven by business developments in China (29.7%; +32.8% at constant exchange rates). North America recorded growth of 8.5% (+13.2% at constant exchange rates) and EMEA growth of 6.8% (+6.9% at constant exchange rates).

The Transportation & Logistics sector represented the business with the highest growth, with a rise in revenues of 13.6% on 2017 (+15.8% at constant exchange rates), thanks to extremely positive performance in North America, where growth was booked at 33.7% (+38.3% at constant exchange rates). In EMEA, growth came in at 3.8% (+3.9% at constant exchange rates).

The Healthcare sector declined by 28.6% (-26.9% at constant exchange rates) on 2017, the year in which it had recorded exceptionally good results thanks to the acquisition of important orders in some of the most important American hospital chains.

Sales through the distribution channel, above all to small and medium customers not directly attributable to any of the 4 main sectors, took a downturn of 30.7%, due to the the reduction of direct sales made by distributors to small and medium businesses (SMB).

The Solution Net Systems Division recorded revenues of €28.3 million, up 14.5% on 2017 (+20.2% at constant exchange rates), mainly due to major orders in the postal sector.

Division EBITDA came to €2.9 million, basically in line with last year; the incidence on revenues is 10.4%.

2018 saw the Informatics Division book turnover of €19.6 million, down 4.9% (-0.5% at constant exchange rates) on 2017, yet improving profitability; the division EBITDA is, in fact, positive for €0.7 million (while it was €0.1 million in 2017), with an incidence on revenues that goes from 0.7% to 3.4%.

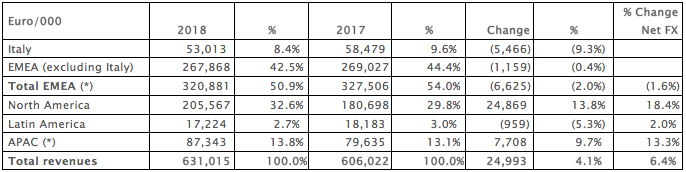

PERFORMANCE BY GEOGRAPHIC AREA

The table below shows Group revenue by geographic area, as achieved in 2018 vs 2017:

(*) EMEA: Europa, Middle East e Africa; APAC: Asia & Pacific including China

At 31 December 2018, sales in Mexico were included in North America; the figures as at 31 December 2017 have been reclassified accordingly.

In 2018, growth was recorded in North America of 13.8% (+18.4% at constant exchange rates) and growth in APAC of 9.7% (+13.3% at constant exchange rates), driven by China, where growth was booked of 13.9% (+16.7% at constant exchange rates).

2018 MAIN EVENTS

On 03 April 2018, in implementation of the shareholders' meeting resolution to authorise the purchase and sale of treasury shares, passed on 04 May 2017, Datalogic S.p.A. stipulated an agreement with an intermediary of primary standing, for the buy-back of treasury shares on the market. This agreement was terminated early on 10 May. More specifically, in the period running from 03 April 2018 to 10 May 2018, the Company bought back 396,773 treasury shares out of a maximum envisaged of 500,000 shares.

On 11 May 2018, in implementation of the shareholders' meeting resolution to authorise the purchase and sale of treasury shares, passed on 04 May 2017, Datalogic S.p.A. conferred a mandate for the launch of a programme offering support of the liquidity of Datalogic shares set to run for a year. The idea behind it was to foster the correct conduct of trading and avoid any price shifts not in line with market performance, in accordance with market practice no. 1 permitted by Consob by Resolution no. 16839 of 19 March 2009. The action taken to support liquidity had been launched starting 16 May 2018, in accordance with market practice no. 1 permitted by Consob by Resolution no. 16839 of 19 March 2009; it was subsequently closed early, on 23 November 2018.

On 23 May 2018, the Board of Directors of Datalogic S.p.A., in confirming the governance structure previously disclosed to the market, confirmed Valentina Volta as Chief Executive Officer of the Datalogic Group, with all executive powers, with the exception of the two areas (“M&A” and “Real Estate”), which will remain exclusively with the Chairman, Romano Volta. It is also specified that Ms Volta is assigned exclusive powers for the area of “Markets-Sales & Marketing” and that all other powers not assigned exclusively to the Chief Executive Officer (“Markets-Sales & Marketing”), or exclusively to the Chairman (“M&A” and “Real Estate”), are shared by the two positions, with separate powers.

On 09 August 2018, the notary Angelo Busani tendered his resignation from the position of Director on the Board, so as to allow for a Board make-up that would even better optimise gender diversity. At the same time, the Board of Directors co-opted Prof. Vera Negri Zamagni.

On 30 November 2018, Alessandro D’Aniello, Group CFO and manager responsible for preparing the company’s financial reports, tendered his resignation with effect starting 20 January 2019. On 07 February 2019, the Board of Directors of Datalogic S.p.A. resolved, after first obtaining the opinion in favour of the Board of Auditors and Control, Risks, Remuneration and Appointments Committee, to appoint Marco Carnovale as manager responsible for preparing the company’s financial reports in accordance with Art. 154-bis of the Consolidated Finance Act.

EVENTS AFTER YEAR-END

There are no significant events to report.

OUTLOOK

The global macroeconomic scenario shows some aspects of political uncertainty and some suggestions that the economic outlook may slow.

In the sector in which the Group operates, long-term development macro trends are confirmed in all the main reference industries, with a demand that Datalogic will continue to satisfy over the coming years: industrial automation and robotics development in the Manufacturing sector; investments in technology to reduce costs and improve the customer experience of Retail sector customers; increased volumes of deliveries following the growth of e-commerce and consequent rise in investments in technologies aiming to minimise error and reduce delivery terms in the Transportation & Logistics sector; and the evolution of the regulatory framework towards higher safety standards in the Healthcare sector.

The Group’s growth strategy plans to steadily increase its investment in Research & Development, constantly improve customer service levels and continuously optimise production costs, as well as closely monitoring operating costs and overheads.

North America is the geographic area in which the greatest growth is expected in 2019.

Unless significant changes occur in the current economic and sector trends, the Group expects to be able to pursue revenue and profitability growth almost in line with 2019, while maintaining a sound financial position and continuing to generate cash.

***

At the Shareholders Meeting scheduled for 30 April 2019, the Board of Directors will propose to distribute an ordinary unit dividend, gross of legal withholdings, of €0.50 per share, for a maximum amount of approximately €29.2 million, with coupon detachment on 27 May 2019 (record date 28 May 2019) and payment from 29 May 2019.

The notice calling the Shareholders' Meeting and the related supporting documents will be made available in accordance with the legal terms and conditions.

***

The Board of Directors also approved the Annual Corporate Governance and Ownership Report and the Consolidated Non-Financial Declaration pursuant to Italian Legislative Decree no. 254/2016. A copy of the reports will be available to the public in accordance with applicable law.

***

Note that the auditing of the draft financial statements has not yet been completed and that the independent auditors’ report will be made available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Finally, the Annual Financial Report (pursuant to article 154-ter of the Consolidated Finance Act) of Datalogic S.p.A. will be available to anyone who requests it at the company headquarters or at Borsa Italiana SpA, on the “eMarket STORAGE” instrument, managed by Spafid Connect S.p.A., and may also be consulted on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations.

***

The manager responsible for preparing the company’s financial reports – Marco Carnovale – declares, pursuant to paragraph 2 of Art. 154-bis of the Consolidated Finance Act, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

***

Note furthermore that this press release contains forward-looking statements about the Group’s intentions, beliefs and current expectations with regard to its financial results and other aspects of the Group's operations and strategies. Readers of the present press release should not place undue reliance on such forward-looking statements, as final results may differ significantly from those contained in the above-mentioned forecasts owing to a number of factors, the majority of which are beyond the Group’s control.

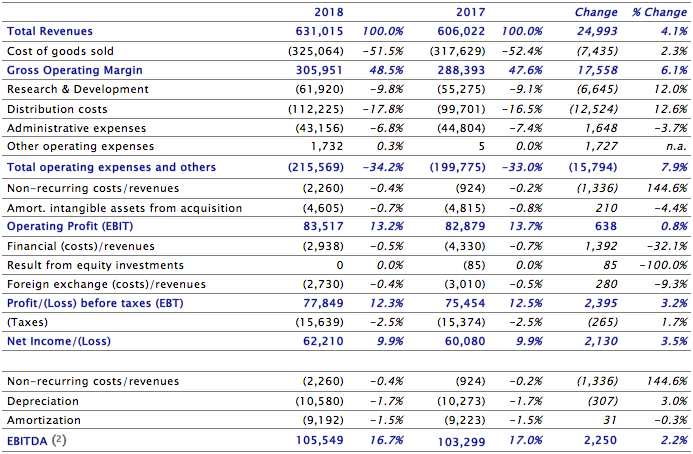

Reclassified income statement at 31 December (1) – Euro/000

1 The reclassified Income Statement and Balance Sheet show measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

2 EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization): this indicator is defined by Datalogic as Profit/Loss for the period before depreciation/amortization of tangible and intangible assets, non-recurring costs/revenues, financial income and expense and income taxes.

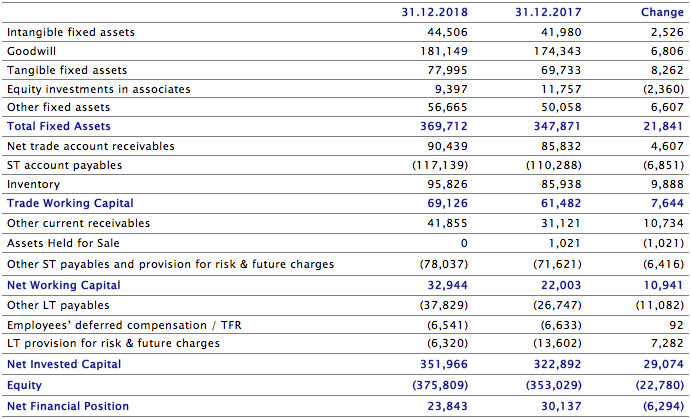

Reclassified Balance Sheet at 31 December 2018 (3) – Euro/1.000

3 The reclassified Income Statement and Balance Sheet show measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

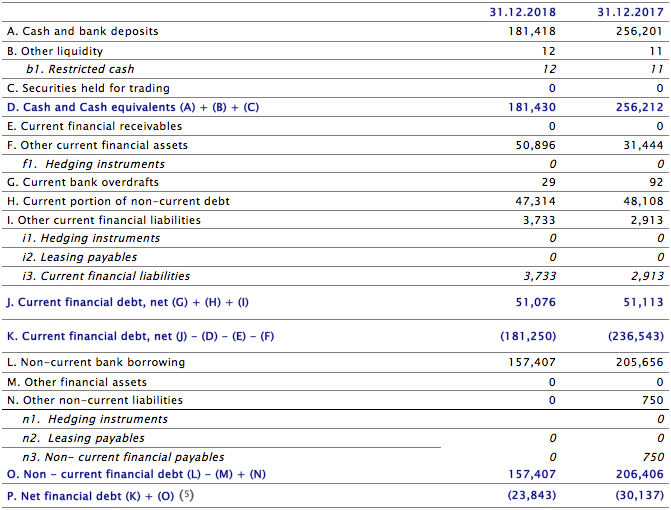

Net Financial Position at 31 December 2018 (4) – Euro/000

4 The reclassified Income Statement and Balance Sheet show measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

5 Net Financial Position or Net Financial Debt: this indicator is calculated in compliance with Consob Communication no. 15519 of 28 July 2006, also including other financial assets consisting of temporary liquidity investments.