|

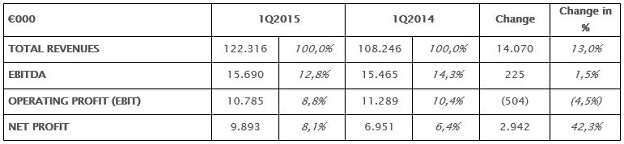

• Sales revenues at 122.3 million Euro, +13% compared to 108.2 million Euro in the first quarter of 2014

• EBITDA grew at 15.7 million Euro compared to 15.5 million Euro in the first quarter of 2014 in spite of greater expenses in R&D and distribution costs, and exchange rates penalizing the operating margin

• Net profit at 9.9 million Euro, +42.3% compared to 6.9 million Euro in the first quarter of 2014

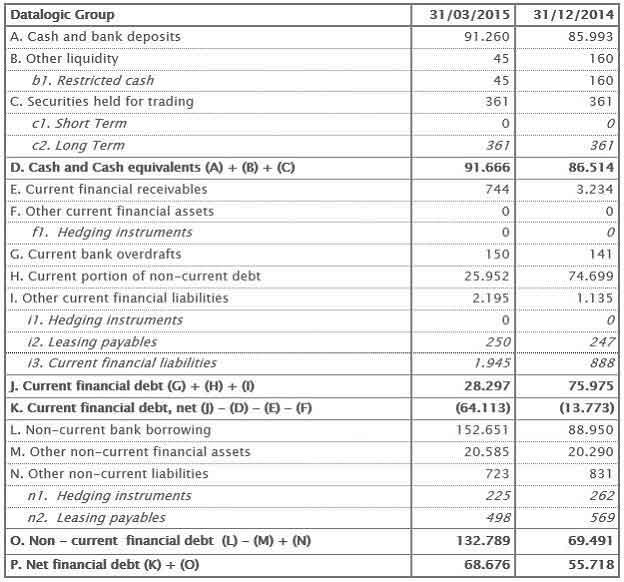

• Consolidated net financial debt at 68.7 million Euro compared to 55.7 million Euro at 31st December 2014

• Romano Volta confirmed CEO for 2015-2017

Bologna, 7th May 2015 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the Quarterly Financial Report at 31st March 2015.

The results for the first quarter, which closed with a growth of 42.3% in net profit at 9.9 million Euro, recorded growth in all the major economic indicators due mainly to a strong recovery in the European market. Exchange rates had a negative effect on EBITDA, which, however, increased by 1.5% to 15.7 million Euro in spite of the higher costs in R&D, up 19%, and distribution costs, up 15.5%. The impact of exchange rates was offset at financial management level allowing a recovery at net margin level.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: "The positive results of the first quarter of the year are mainly due to customers in the Retail sector who have chosen Datalogic as their preferred supplier for in-counter scanners, to the strengthening of the confidence in our distributors and retailers in Europe and to the double-digit growth in Asia. Negotiations were launched in the United States during the quarter with important Fortune companies in the logistics and transportation sector for the supply of our products and solutions for goods sorting and checking. We are also very satisfied with the progress made in R&D and the foundations laid for the development of new interesting products for our customers."

Consolidated sales revenues for the first quarter of 2015 came in at 122.3 million Euro, with a growth of 13% compared to the first quarter of 2014 (+4% at constant exchange rates). The booking during the quarter – the orders already received - were equal to 142.8 million Euro, approx. +22.9% compared to the first quarter of 2014 (orders/sales ratio for the period of approximately 117%).

The percentage of new products[1] over sales for the period rose to 25%.

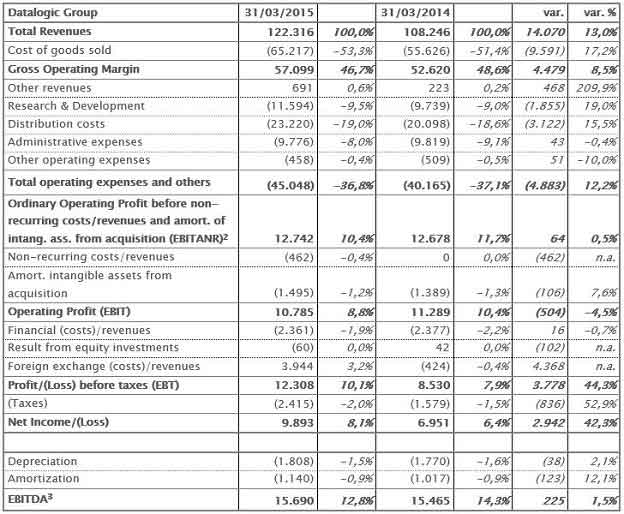

Gross operating margin came in at 57.1 million Euro compared to 52.6 million Euro of the same period of the previous year and its incidence on revenue decreased from 48.6% to 46.7%, mainly due to exchange rate effect.

The Group's EBITDA grew by 1.5%, standing at 15.7 million Euro compared with 15.5 million Euro for the first quarter of 2014, with a fall in the EBITDA margin for the quarter from 14.3% to 12.8%. As highlighted previously, the reduction in the margin is due to the effect of exchange rates, net of which the EBITDA margin would have remained stable at 14.3%. Investments in R&D went from 9.7 million Euro for the first quarter of 2014 to 11.6 million Euro, with the percentage over revenues increasing from 9.0% to 9.5% in the respective quarters - and distribution costs increasing from 20.1 million Euro to 23.2 million Euro on account of the strengthening of the sales force. General Administrative Expenses remained essentially stable at 9.8 million Euro in line with the same period for the previous financial year.

Financial expenses of 2.4 million Euro were essentially in line with the first quarter of 2014. Earnings on exchange rates of 3.9 million Euro were recorded (compared with exchange rate losses of 0.4 million Euro in the first quarter of 2014) which offset the exchange rate effect recorded at marginal level.

Group net profit came in at 9.9 million Euro compared to 6.9 million Euro in the same period of the previous year.

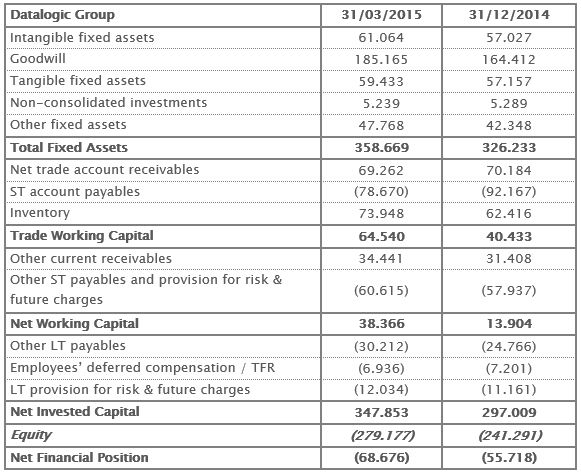

As of 31st March 2015, net financial debt was 68.7 million Euro, compared to 55.7 million Euro as of 31st December 2014. The change was mainly due to investments in the period and to the increase in Trade Working Capital, equal to 64.5 million Euro compared with 40.4 million Euro as at 31st December 2014, supporting the launch of new products.

[1] New products are products launched in the last 24 months

Comparison between first quarter 2015 and first quarter 2014

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, continues to show a very positive trend in all the reference markets, in particular in EMEA, thanks to the continuous product innovation. Specifically, note the new products launched in the segment of Hand Helds and Mobile Computers: the Cobalto™ presentation scanner, the new Heron™ linear imager scanner and the Joya X2, the device for self-shopping. The Division registered revenues of 84 million Euro up by +16.8% compared to the first quarter of 2014 (+7.2% at constant exchange rates) and an EBITDA of 16.2 million Euro (19,3% on revenues), percentage substantially in line with the first quarter of 2014.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market has grown by 3.9% to 31.7 million Euro compared to the first quarter of 2014 (-2% at constant exchange rates). Net of the result of the Systems Business Unit, which enjoyed the benefit of the tail end of a multi-year contract in Q1 2014, the division's revenue increased by 11% to 28.9 million Euro (+6.5% at constant exchange rates) and EBITDA more than doubled to 1.6 million Euro.

Finally Informatics registered sales of 7.0 million Euro compared to 6.1 million Euro in the first quarter of 2014 and 6.4 million Euro in the fourth quarter of 2014.

With regard to geographical areas, in the first quarter of 2015 the performance of the European market was positive with growth of 7.6% to 63.4 million Euro. The performance of sales in the emerging markets in Asia and the rest of the world was very positive, with growth, respectively of 30.2% to 15.5 million Euro and 26.3% to 9.2 million Euro. North America recorded growth in sales of 13.4% to 34.1 million Euro, especially thanks to the effect of exchange rates and a significant increase in orders in both the Retail segment and in Transportation & Logistics.

PERIOD EVENTS

On 25th February 2015 a medium term debt refinancing was completed.

The refinancing contract, signed with a Banking Pool, is worth 140 million Euro with an interest rate that reflects market rates and a five year repayment term with covenants that are substantially in line with the best practice of Datalogic Group for this kind of transaction.

SUBSEQUENT EVENTS

The Board of Directors deemed that the hypothesis in Article 2497-sexies of the Italian Civil Code was exceeded, revealing the absence of management and coordination activity by the Parent Company Hydra S.p.A. over Datalogic.

OUTLOOK FOR CURRENT YEAR

The results of the first quarter confirm the positive trend of the Group especially in Europe. This growth is evidence of the market's approval of the technological solutions which have been the fruit of intensive research and development activity and close collaboration with our customers.

Significant investments in Research and Development continued; specifically, innovation in the Business Development division has become the cornerstone of Datalogic's future, a dynamic and effective across-the-board structure giving the group a systematic approach to make technology the essential driver for growth and the creation of value.

Also taking into consideration the positive performance of booking in the quarter, we expect a recovery in 2015 in the reference markets, with the two main operating divisions, ADC and Industrial Automation, managing to leverage the significant investments made and in progress to improve product ranges and increase market share.

Please note that the Interim Management Statement at 31st March 2015 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

* * *

The Board of Directors also defined its governance structure and, specifically, it has confirmed the Chairman, Romano Volta, in the position of CEO, also giving him responsibility for the internal control system and risk management, as well as appointing the Director Carlo Aversa as Managing Director the rationalization of all the Group Operations.

Based on the available information and the statements made by the parties involved, the Board has also evaluated the existence of the requirements of independence, pursuant to both Legislative Decree 58/1998 and the Borsa Italiana Code of Conduct, with regard to the two independent directors Luigi Di Stefano and Gaia Mazzalveri, appointing the latter to the post of Lead Independent Director and establishing the "Control, Risks, Remuneration and Appointments Committee", comprising Gaia Mazzalveri (Chairman), Luigi Di Stefano and Filippo Maria Volta.

Lastly, the following senior managers were confirmed as having strategic responsibilities:

- Chief Executive Officer of the Industrial Automation Division and Business Development Division, Valentina Volta;

- Chief Executive Officer of the Automatic Data Capture Division, Bill Parnell;

- Group Chief Financial Officer, Sergio Borgheresi;

- Group Chief Technology Officer, Piero Todescato;

- Group Chief Human Resources Officer, Michele Marchesan;

- Group General Counsel, Federica Lolli;

- Group Chief Information Officer, Giovanni Sgalambro.

Sergio Borgheresi – Group CFO - was confirmed as the director responsible for preparing the corporate accounting documents.

***

The manager responsible for preparing the company’s financial reports – Sergio Borgheresi – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st March 2015 – Euro/1.000

Note: In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[2] EBITANR – Earnings before interest, taxes, acquisition and non recurring.

[3] EBITDA - Earnings before interest, taxes, depreciation and amortization.

Reclassified Balance Sheet at 31st March 2015 – Euro/1.000

Net Financial Position at 31st March 2015 – Euro/1.000

|