Press Releases

Press Releases

The Board of Directors approved the Quarterly Report at 30 September 2018

|

REVENUES UP 3.4% AT €466.1 MILLION (+6.9% AT CONSTANT EXCHANGE RATES) EBITDA AT €77.5 MILLION, 16.6% ON REVENUES NET PROFIT AT €43.6 MILLION, 9.3% ON REVENUES NET FINANCIAL POSITION POSITIVE AT €10.9 MILLION

Bologna, 13th November 2018 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and process automation markets, approved today the Quarterly Financial Report at 30th September 2018.

Valentina Volta, the Chief Executive Officer of the Datalogic Group, commented: “We are satisfied with the results obtained for the quarter which confirm the progressive growth of sales during the year, in spite of the detrimental effect of exchange rates. In particular, I want to highlight the excellent performance of North America, which grew by 46% over the quarter and was driven by Retail (+72% yoy) and T&L (+117% yoy) as well as the very positive performance of Manufacturing and T&L in all the main geographical areas. Investments in R&D have continued, which have made possible, among other things, to obtain Google certification for the use of the Android operating system by a new range of terminals soon to be launched on the market. Profitability has remained essentially in line with last year’s level, even after taking into consideration the significant investments in R&D and in the sales structure. In the absence of significant changes in sector trends, I am confident that the Group will be able to close the year with further growth in revenues compared to the trend of previous quarters.”

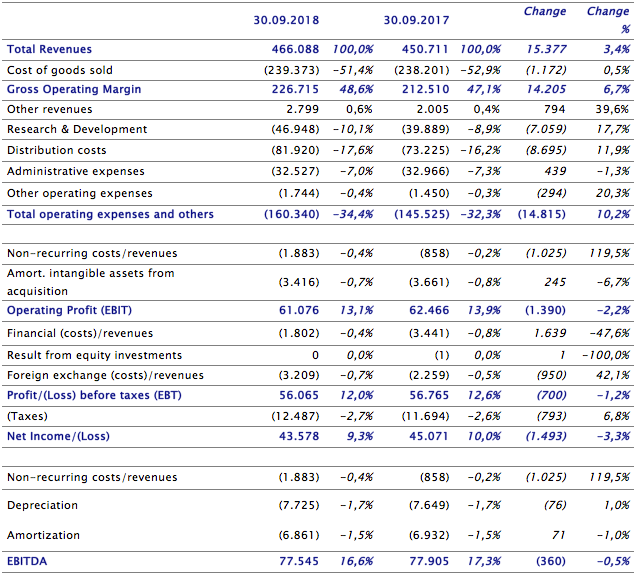

Consolidated net revenues amounted to €466.1 million and, despite the unfavourable trend of the Euro/Dollar exchange rate, increased by 3.4% compared to €450.7 million as at 30 September 2017 (+6.9%, at constant exchange rates).

The gross operating margin, amounting to €226.7 million, increased by 6.7% compared to €212.5 million in the same period of the previous year and with respect to revenues increased by 1.5 percentage points, rising from 47.1% in the first nine months of 2017 to 48.6% in 2018. The improvement is mainly due to the improvement in the sales mix and efficiencies in the cost of goods sold.

Operating costs, amounting to €160.3 million, increased by 10.2% compared to €145.5 million in the same period of 2017, and increased by 2.1 percentage points with respect to revenues, up from 32.3% to 34.4%. R&D expenses increased by 17.7% to €46.9 million, accounting for 10.1% of revenues compared to 8.9% in the same period of 2017. Distribution expenses increased by 11.9% to €81.9 million, accounting for 17.6% of revenues compared to 16.2% in the same period of 2017. These expenses were affected by the strengthening of the R&D and distribution organizational structures. General and administrative expenses amounted to €32.5 million, down 1.3% compared to €33 million, falling to 7.0% from 7.3% with respect to revenues in the first nine months of 2017.

EBITDA, equal to €77.5 million, essentially in line compared to €77.9 million of the same period of 2017 (-1.5%, at constant exchange rates), while with respect to revenues (EBITDA margin) fell from 17.3% in 2017 to 16.6% in 2018, mainly due to greater investments in R&D, described above, and to the strengthening of commercial organisations, partially offset by the improvement in the gross operating margin, and by a cost control of the general and administrative expenses.

EBIT, equal to €61.1 million, decreased by 2.2% against €62.5 million, while its percentage of revenues dropped from 13.9% in the first nine months of 2017 to 13.1% for the same period in 2018. The result was affected by non-recurring charges, equal to €1.9 million (€0.9 million in the first nine months of 2017), related primarily to restructuring transactions of some corporate departments and the reorganisation of the industrial and distribution footprint.

Financial management was negative for €5 million, compared to a negative result of €5.7 million in the same period of 2017. The improvement is mainly attributable to benefits from renegotiating the cost of outstanding loans and by a reduction in banking charges, partially offset by the increase in exchange differences recorded on currency exposures.

The Group net profit, amounting to €43.6 million, decreased by 3.3% compared to the €45 million profit recorded in the same period of the previous year. The percentage on revenues was 9.3%.

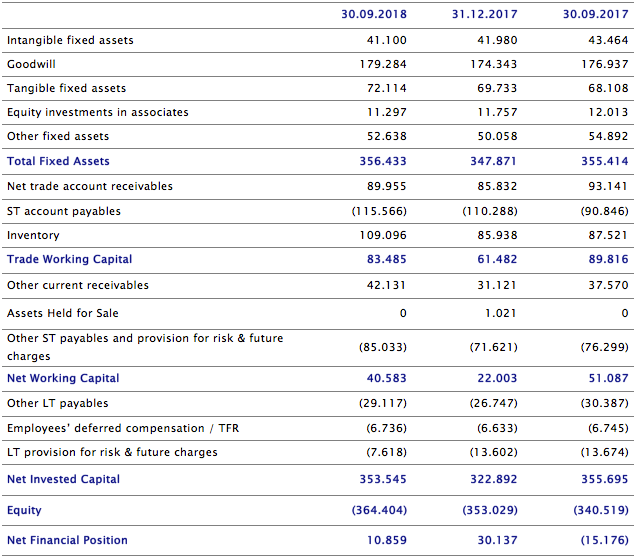

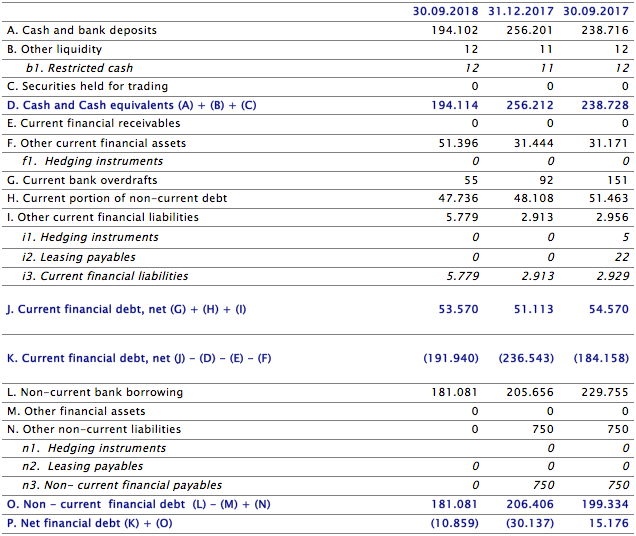

The Net Financial Position, as at 30 September 2018 was positive by €10.9 million, an improvement of €26 million compared to 30 September 2017 (negative by €15.2 million) and down by €19.3 million with respect to 31 December 2017 (positive by €30.1 million). Al netto degli acquisti di azioni proprie e della distribuzione dei dividendi, la generazione di cassa del periodo derivante dalle attività di business è positiva per 20,5 milioni di Euro, in crescita rispetto ai primi nove mesi del 2017 in cui, escludendo la distribuzione dei dividendi e l’acquisizione di Soredi Touch Systems GMBH, la generazione di cassa sarebbe stata positiva per 6,6 milioni.

The Trade working capital as at 30 September 2018 amounted to €83.5 million, an increase of €22 million compared to 31 December 2017 and down by €6.3 million compared to 30 September 2017, with a percentage on revenues of 13.4% decreased compared to September 2017 (14.8%).

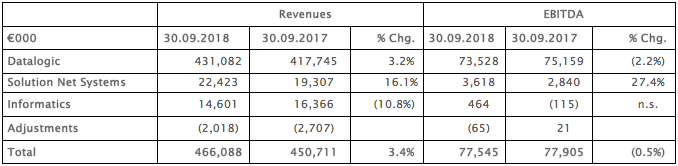

9M PERFORMANCE BY DIVISION

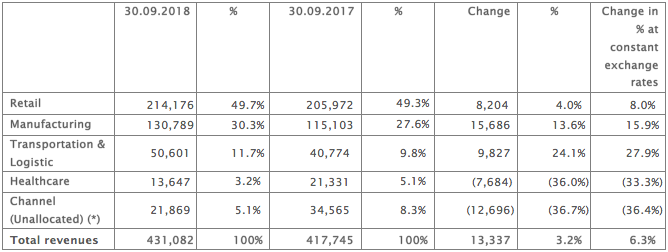

In the first nine months of the year, the Datalogic Division reported a turnover of €431.1 million, an increase of 3.2% compared to the same period of 2017 (+6.3% at constant exchange rates), with a significantly positive trend in North America where a growth of 8.7% (+15.5% at constant exchange rates) was recorded and in APAC, especially in China and Korea, which reported a growth of 15.5% (+20.1% at constant exchange rates). EBITDA related to the division amounted to €73.5 million, down 2.2%, corresponding to 17.1% of sales (18% as at 30 September 2017). This decrease is attributable to greater investments in R&D and the increase in commercial expenses. The following table provides a breakdown of the revenues of the Datalogic Division, by business sector:

(*) The Channel sector (Unallocated) includes the revenues which are not directly attributable to the 4 sectors identified. (**) Data for 2017 have been restated.

The Retail sector reported a 4% increase compared to last year (+8% at constant exchange rate), mainly in North America (+26.8% and +35.1% at constant exchange rate). The Manufacturing sector confirmed its expansion trend, up by 13.6% compared to the previous year (+15.9% at constant exchange rate); growth was recorded in all the main geographical areas and in particular in China and Korea (+38.4%) as well as in EMEA (+8.1%). The Transportation & Logistics sector reported a 24.1% increase compared to the same period of 2017 (+27.9% at constant exchange rate), with strong growth in particular in North America (+52%), China and Korea (+10.7%) and EMEA (+10.1%). The Healthcare sector reported a 36% decrease (-33.3% at constant exchange rate), compared to the first nine months of 2017, which had posted exceptionally positive results due to the acquisition of important orders in some of the leading US hospital chains. The sales through distribution channel, especially to small and medium-sized customers, not directly attributable to any of the four main sectors, reported a 36.7% decrease due to a physiological seasonal trend of stock reduction in the main distributors in the first part of the year and to the timing of the launch of new products dedicated to the distribution channel. The Solution Net Systems Division recorded revenues of €22.4 million, an increase of 16.1% compared to the first nine months of 2017 (+24.4% at constant exchange rates) mainly due to the acquisition of further important orders, both in the postal and retail sectors. EBITDA related to the Division amounted to €3.6 million, with a 16.1% impact on revenues, compared to 14.7% in the same period of 2017. In the first nine months of 2018, the Informatics Division recorded a turnover of €14.6 million, down 10.8% (-4.3% at constant exchange rate) compared to the same period in 2017. EBITDA for the division amounted to €0.5 million (negative by €0.1 million in the same period of 2017).

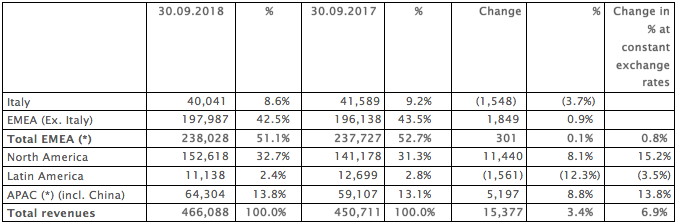

9M PERFORMANCE BY GEOGRAPHIC AREA The following table shows the breakdown by geographical area of Group revenues achieved in the first nine months of 2018 compared to the same period of 2017:

During the first nine months of 2018, strong growth was recorded mainly for North America for 8.1% (+15.2% at constant exchange rate) and APAC for 8.8% (+13.8% at constant exchange rate), driven by China and Korea (+15.5% and +20.1% at constant exchange rate). QUARTER PERFORMANCE

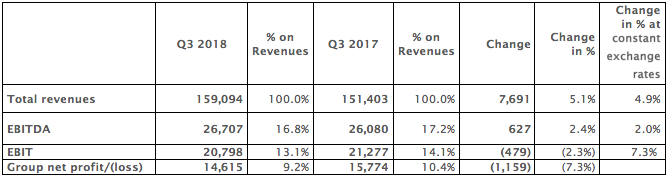

Total revenues in the third quarter of 2018 amounted to €159.1 million, up 5.1% compared to the third quarter of 2017 (+4.9% at constant exchange rate). In the third quarter, the Datalogic Division reported a turnover of €146.8 million, up by 5.9% compared to the same period of 2017 (+5.8% at constant exchange rate), with a particularly positive growth of 45.7% in North America. EBITDA for the third quarter showed an increase of 2.4% (+2% at constant exchange rate). As a percentage of revenues (EBITDA margin), it stood at 16.8% (17.2% in the third quarter of 2017) and was affected by greater investments in R&D of 10.4% (9.0% in the third quarter of 2017) and the strengthening of sales organisations, partially offset by the improvement in gross profit and by the containment of overheads and administrative expenses.

SIGNIFICANT EVENTS FOR THE QUARTER AND SUBSEQUENT TO THE END OF THE QUARTER No significant events are to be reported. BUSINESS OUTLOOK Despite the negative impact on sales due to the Euro/Dollar exchange rate, especially in the first half of the year, the results for the first nine months of the year reported a continued growth in revenues, in line with the business forecasts of a gradual and steady quarterly improvement of growth rates compared to the same period last year. The Group continues its growth strategy focused on a continuous increase in R&D investments, an improvement of service levels offered to customers, a further improvement of all sales organisations in the main development areas, with special focus on North America, and the continuous optimisation of production costs, combined with a thorough control on operating costs and overheads. Of particular significance in the last few months was the completion of the technological switch to the Android operating system of the entire mobility products line and the achievement of “Android Enterprise Recommended” Google product certification for Memor 10, the first of a new family of PDA products with unique characteristics in the market. The launch of Memor 10 will take place in the near future and will be an important component of the strong pipeline expected for the next few months. Even though the activities to complete the switch to the Android technology have taken longer than anticipated, with the consequent delay in the launch of some important new products, on the basis of the expectations of further growth in revenues for the last quarter of the year and in the absence of significant changes in economic and sector trends, the Group expects to end the year with revenues growing further than the trend in the first nine months, while maintaining the EBITDA margin essentially in line with last year, and continuing to preserve its financial solidity.

*** Please note that the Quarterly Report at 30th September 2018 of Datalogic S.p.A. will be available to anyone who requests it at the company headquarters, at the offices of Borsa Italiana S.p.A. (www.borsaitaliana.it), on the “eMarket STORAGE” instrument, managed by Spafid Connect S.p.A. and may also available on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations. *** The manager responsible for preparing the company’s financial reports – Alessandro D’Aniello – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records. *** It should also be noted that this press release contains forward-looking statements concerning the Group's intentions, beliefs or current expectations in relation to financial results and other aspects of the Group's activities and strategies. The reader of this press release should not place undue reliance on these forward-looking statements, as the actual results could differ significantly from those contained in said statements, as a result of a number of factors, most of which are outside of the Group's control.

Reclassified income statement at 30 September 2018 – Euro/1.000

Reclassified Balance Sheet at 30 September 2018 () – Euro/1.000

|

|

Net Financial Position at 30 September 2018 – Euro/1.000

|

Il Presidente e Amministratore Delegato del Gruppo Datalogic, Romano Volta, ha così commentato: “I risultati positivi del semestre rafforzano la validità delle scelte strategiche avviate sia a livello gestionale che di prodotto che hanno permesso una crescita a doppia cifra in Europa e nei Paesi Asiatici. Il retail si conferma essere il motore della crescita ma nel semestre si è assistito anche ad una ripresa nel segmento industriale grazie all’introduzione sul mercato di nuovi prodotti basati su tecnologia imaging per la logistica ed il mondo del factory automation in crescita in Europa. Il contratto acquisito con Royal Mail costituisce inoltre un’interessante premessa per il rilancio della business unit Systems in coerenza con le altre attività del Gruppo.”