Press Releases

Press Releases

Datalogic Group 3 year plan 2010-2012 approved. The plan was presented to the financial community on October 4, 2010

|

Datalogic in 2012: Growth drivers: Bologna, October 4, 2010 - The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the Milan Stock Exchange - Star Segment- organized and managed by Borsa Italiana S.p.A. ("Datalogic") and a leader in the market for bar code readers, data collection mobile computers, RFID and vision systems, today approved the Group's 3 Year Plan for 2010-2012.

Mauro Sacchetto, CEO of Datalogic S.p.A., commented as follows: “The brilliant results achieved by Datalogic in the recent complex market scenario, confirmed the validity of the measures promptly taken starting from last spring and continued in subsequent quarters. These decisions have made us the solid and efficient Group we are today, with a structural cost base lower than in previous years and a high level of industrial productivity: a Group ready to face market challenges and continue with future growth and expansion, also through external growth. Targets are clear and definite. By 2012 the Datalogic Group will strengthen its competitive position in reference markets and focus on growth in, till now, marginal countries. This will be possible thanks to continuous investment in innovative technologies, in particular Imaging and Vision, which will allow our entry into higher value markets.”

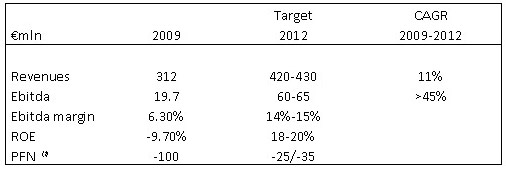

Strategic drivers Innovation Strengthening of strategic positioning The Factory Automation (FA) market, extremely fragmented and with strong growth potential, presents new opportunities. Datalogic intends to aggressively enter this market also through external growth; solid cash generation and our capacity to identify targets, currently not included in the Plan, which could enable the Group to make a significant size improvement. International expansion Productivity and efficiency improvement The strengthening of control procedures, optimization of back-office methods and reengineering of production processes will allow a marked improvement in Group operating expenses and working capital. On the basis of these strategic growth drivers, in 2012 the Datalogic Group expects to reach a consolidated turnover between Euro 420 and 430 million, with a CAGR 2009-2012 equal to 11%. The strengthening by external growth, at present not considered in the plan, could result in additional turnover of approximately Euro 100 million, taking turnover into the Euro 520 - 530 million range. Thanks to the additional benefits in terms of efficiency and productivity recovery, in 2012 EBITDA between Euro 60 and 65 million is expected, with an EBITDA margin between 14 and 15%, compared to 6% achieved in 2009. Cash flow management will be aimed at reducing debt (with the net financial position (¹) expected to improve in the range of Euro -25 and -35 million in 2012 compared to Euro -100 million in 2009) yielding on the invested capital and guaranteeing an important level of R&D investments of 7-8%. With respect to Capex, investments will continue at an ordinary level (2.5% annually). Actions outlined in the 3 Year Plan will allow the achievement of high levels of profitability and value generation, with double-digit growth in ROE, which is expected to stabilize, at the end of the period, in the range of 18% and 20%. The 3 Year Plan for 2010-2012 will be presented today – Monday, October 4, 2010 – at the Sala Gialla of Palazzo Mezzanotte Congress Centre and Services, Piazza degli Affari, 6, Milan, from 11 am. The documents which will be presented to the financial community are attached to this press release. Information contained in this press release and in the attached documentation include forward-looking statements relevant to future events and future performance of Datalogic and Datalogic Group, based on present expectations, estimates, outlooks and projections of the sectors in which Datalogic and Datalogic Group operate and assessments, assumptions and estimates of the future evolution of Datalogic management. In Particular, some statements concerning management targets, operating result trends, margins, costs, ROE and risk management, are estimated. Idioms such as "it is expected", "it is estimated", "it is aimed at", "according to projections", "the group intends", "according to plans", "the group believes", the group tries", "the group considers" and the use of variants or similar words, indicate estimated statements. These forward-looking statements are based exclusively upon expectations and therefore subject to risks, uncertainties and assumptions, difficult to forecast, being connected to future events and strictly depending upon circumstances which will occur in the future. Therefore, actual results of Datalogic and Datalogic Group could differ, also to a significant and unfavorable extent, from what stated or understood in each estimated statement. The factors which could cause the aforesaid differences or contribute to them include, by way of an example, not exhaustive, global economic conditions, political and economic conditions and development of national or international regulations.

|

| (¹) PFN calculated gross of expected dividends. |