|

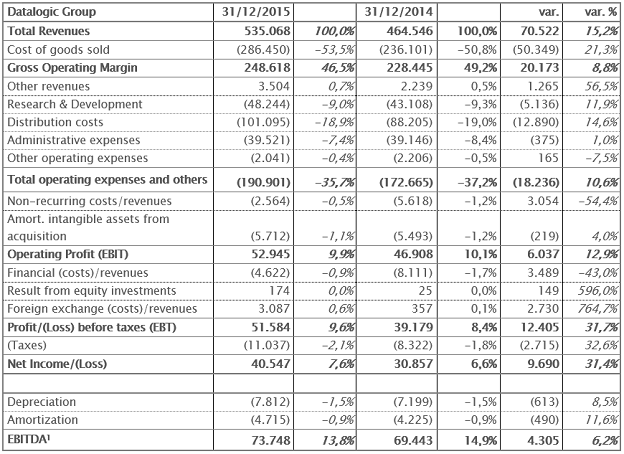

• Sales revenue at 535.1 million Euro, +15.2% compared to 464.5 million Euro in the previous year (+5.9% net of the exchange rate effect)

• EBITDA at 73.7 million Euro, +6.2% compared to 69.4 million Euro in 2014 (+8.6% net of the exchange rate effect)

• Net profit at 40.5 million Euro, +31.4% compared to 30.9 million Euro in the previous year

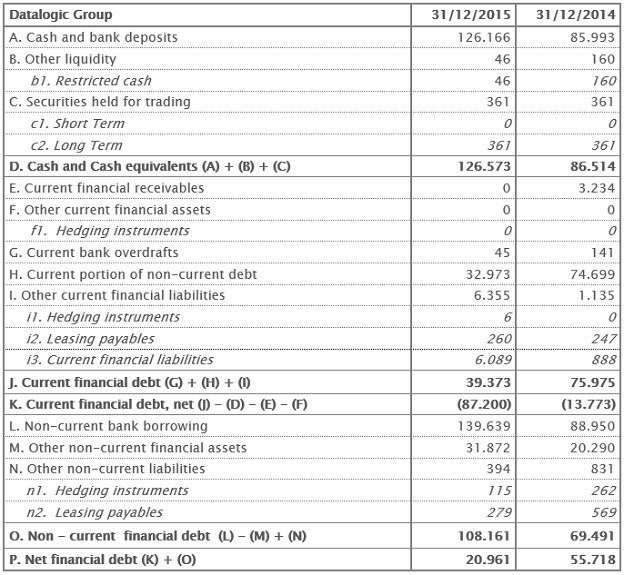

• Significant reduction of financial debt to 21 million Euro compared to 55.7 million Euro as of 31st December 2014, thanks to the continuous generation of cash

• The BoD proposed to Shareholders’ Meeting a dividend, gross of legal withholdings, of 25 eurocents per share with a growth of +38.9% compared to the previous year

• Sergio Borgheresi approved the 2015 Annual Financial Statement and left Datalogic Group. Stefano Biordi has been appointed Group CFO ad interim and Manager in charge for preparing corporate accounting documents.

Bologna, 4th March 2016 – Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”), a global leader in Automatic Data Capture and Industrial Automation markets, and world-class producer of bar code readers, mobile computers, sensors for detection, measurement and safety, vision systems and laser marking equipment, approved today the draft Financial Statements and the Consolidated Financial Statements as of 31st December 2015.

Fiscal year 2015 ended with a significantly improved results both in terms of revenue, which grew by 15.2% to 535.1 million Euro and profitability - a 31.4% increase in net profit to 40.5 million Euro. Such improvement, which is the result of constant product innovation to satisfy customer needs, involved both the ADC and the IA divisions, and the main reference markets, Europe, China and the United States in particular, where the distribution network was significantly strengthened.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: "The results of the financial year that has just ended confirm the validity of the strategic implementation choices of recent years. In particular the move from a product centric logic to one where the customer is at the centre of research and development and distribution efforts is beginning to reap its benefits. We are leveraging Datalogic's uniqueness in satisfying our customers' entire value chain: from managing their stores, to logistics and on to the management of their point of sale. The investments made in 2015 in terms of sales force, rationalization of production and purchasing have generated very positive results that we count on improving further in the current financial year. Looking to the future, 2016 will indeed be a year that will derive further benefit from the optimization and rationalization of the manufacturing processes currently underway, in addition to a sales approach that is increasingly customer driven".

Sales revenues in 2015 came in at 535.1 million Euro, a 15.2% increase compared to 464.5 million Euro in the previous year. At a constant Euro/Dollar exchange rate, growth would have been 5.9%. Bookings reached 563.3 million Euro, a 17.6% growth compared to the same period in 2014. The incidence on revenues generated by new products (launched in the last 24 months) was 26.7%.

The Gross Operating Margin of 248.6 million Euro is the result of a 8.8% growth compared to 228.4 million Euro of the previous financial year (+4.1% at constant exchange rate), while its effect on revenues went from 49.2% in 2014 to 46.5% in 2015. Such trend is mainly due to the combined effect of the Euro/Dollar exchange rate trend and the lowering of margin of the Systems Business Unit. Net of such effects, the gross operating margin would have been 49.9%.

Operating costs worth 190.9 million Euro, increased by 10.6% compared to 172.7 million Euro in 2014 (+2.8% at constant exchange rate) but their effect on revenue goes from 37.2% to 35.7%. Research and Development costs were higher, increasing by 11.9% to 48.2 million Euro from 43.1 million Euro, with a substantially stable effect on revenues at 9% compared to 9.3% in 2014. Distribution costs stood at 101.1 million Euro with a 14.6% increase compared to 2014, mainly due to the strengthening of the sales force in North America, while General and Administrative expenses increased by only 1% to 39.5 million Euro thanks to a greater monitoring.

The EBITDA increased by 6.2% to 73.7 million Euro compared to 69.4 million Euro registered in 2014 (+8.6% at constant exchange rate), with an effect on revenue (EBITDA margin) of 13.8% compared to 14.9% in the previous financial year. The reduction of margin is mainly attributable to the exchange rate effect, net of which margin would have been 15.3%, thanks to the confirmed high margins of the ADC Division and the results of the product operating cost reduction projects.

The Operating Result grew by 12.9% to 52.9 million Euro from 46.9 million Euro (+25.8% at constant exchange rate).

Financial charges stood at 4.6 million Euro, representing a steep fall compared to 8.1 million Euro in 2014, thanks to the signature on February of a new financing contract with a banking pool, while registering foreign exchange revenues of 3.1 million Euro compared to 0.4 million Euro in the previous financial year.

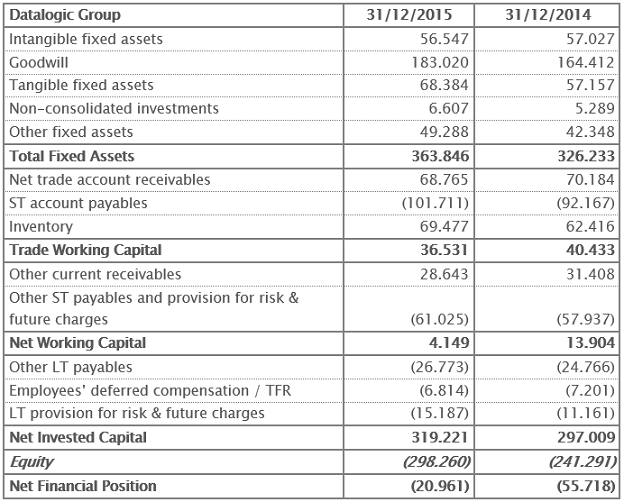

The Group Net Profit increased by 31.4% to 40.5 million Euro compared to 30.9 million Euro registered in the previous financial year. There was a significant reduction of net financial debt down to 21 million Euro compared to 55.7 million Euro as of 31st December 2014, thanks to the solid and continuous generation of cash.

Trade Working Capital as of 31st December 2015 was 36.5 million Euro, lower than 40.4 million Euro as of 31st December 2014.

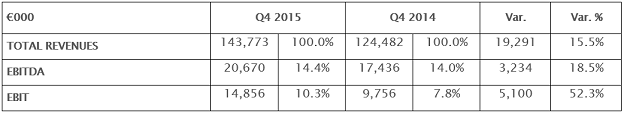

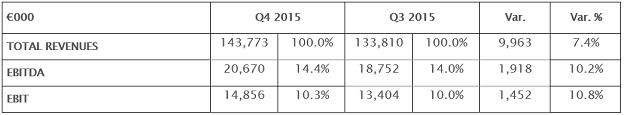

Q4 2015 TRENDS

Q4 2015 was the best quarter over the last two financial years both in terms of revenues growth as well as increase in profitability. It highlighted an acceleration compared to the fourth quarter of the previous financial year with revenue rising to 143.8 million Euro (+15.5% compared to Q4 2014 and +7.4% compared to Q3 2015) and operating margin - EBITDA at 20.7 million Euro (+18.5% compared to Q4 2014 and +10.2% compared to Q3 2015). Bookings during the quarter was 158.2 million Euros, up by 21.3% compared to Q4 2014.

Comparison between Q4 2015 and Q4 2014

Comparison between Q4 2015 and Q3 2015

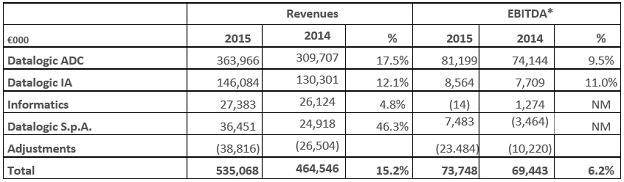

PERFORMANCE BY DIVISION

(*) With the purpose to better report the operating sectors economic performances, it was deemed appropriate to highlight the Divisional EBITDA as monitoring KPI.

The ADC (Automatic Data Capture) Division specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, continues in its growth path thanks to the introduction of new technologically advanced products. The Division registered revenues of 364 million Euro, with a growth of 17.5% compared to 309.7 million Euro in 2014 (+8.2% at constant exchange rate), and a very high growth in EBITDA (+9.5% to 81.2 million Euro with an EBITDA Margin of 22.3%). In particular 2015 was a year of sustained growth for handheld readers, a market in which Datalogic confirmed its worldwide leadership thanks to a complete renewal of its product line with technology for reading 2D codes (the new Quickscan, Powerscan and Heron product families are among the main product lines introduced in 2015) and it was also very positive for fixed scanners mainly thanks to the Magellan line with laser and imager technologies.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, registered revenues of 146.1 million Euro, up by 12.1% compared to 130.3 million Euro registered in 2014 (+4.7% at constant exchange rate) confirming recovery that had started in Q4 2013. Net of the result of the Systems Business Unit, which benefitted of the execution of the first part of the Royal Mail order for an amount of approximately 4.2 million Euro, the division's revenue increased by 12.6% to 129 million Euro (+6.2% at constant exchange rate). Such growth is driven by the launch of new products in the identification and sensors segment, dedicated to the Factory Automation and the T&L segments. The division's margin is in line with the previous financial year - EBITDA margin of 5.9% - notwithstanding greater Research and Development costs which rose from 11.3% to 12.3% of the revenues, and greater costs in the Distribution Network mainly in the United States which rose from 25.4% to 27.0% of the revenues.

Lastly, Informatics registered revenues of 27.4 million Euro compared to 26.1 million Euro in 2014.

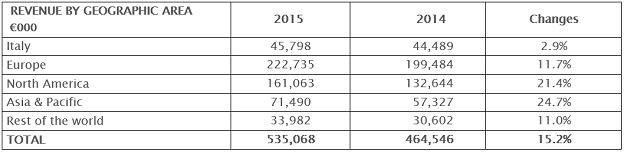

PERFORMANCE BY GEOGRAPHICAL AREA

Regarding geographic areas, the European market, which represents approximately 50% of the revenues, continued to register a significant growth (+8.5% YoY) in both ADC as well as IA. North America is starting to enjoy the benefit of investments in the sales force winning important projects for fixed scanners and handheld readers in the Retail sector and the launch of new products in the FA and T&L segments.

PERIOD EVENTS

On 24th February a medium term debt refinancing operation was completed with a pool of banks for an overall amount of 140 million Euro with an interest rate that reflects market rates and a five year repayment term and with covenants that are substantially in line with the best practice of Datalogic Group for this kind of transaction. This operation enables Datalogic to further improve its financial structure by lengthening the average repayment term of medium-term debt from the current almost two to four years and to reduce the average cost of debt.

On 28th April, the Shareholders' Meeting appointed the new Board of Directors of the Company for the three year period from 2015 to 2017.

On 13th May 2015 Michele Marchesan was appointed Senior Vice President and Chief Human Resources Officer.

On 29th May an agreement was signed with Royal Mail to implement a new Parcel Sorting System in around 20 mail centres across the UK. The total value of the deal is approximately 29 million Euro.

On 7th August, Pietro Todescato was appointed as the new Chief Executive Officer of Datalogic ADC, following the resignation of Bill Parnell.

On 10th December an agreement was signed for the acquisition of 20% of CAEN RFID Srl, a Tuscan company at the forefront of RFID (Radio Frequency Identification) in the UHF (Ultra High Frequency) band, and a commercial agreement that includes, among others, the combined development of new products, the use of CAEN RFID’s components by Datalogic for the manufacturing of its products and the distribution of CAEN RFID’s products with Datalogic brand.

On 18th December 2015 a financing contract was signed with the European Investment Bank (EIB) for a five-year amortising loan worth a total of 30 million Euro to support investments, research and development and technological innovation of the Group.

On 29th December, following the resignation on the same date of Dr. Enrico Cervellera, alternate statutory auditor Mario Fuzzi took over as Chairman of the Board of Statutory Auditors. Mr. Fuzzi will remain appointed until the next Shareholders' Meeting.

On 31st December, the Chief Information Officer ("CIO") Giovanni Sgalambro terminated his employment with the Datalogic Group. The company has already activated a recruitment process for a new CIO.

SUBSEQUENT EVENTS

Datalogic informs that, with effect from today (following the approval of the annual financial report as of December 31st, 2015), Sergio Borgheresi - current Group Chief Financial Officer ("CFO") and Investor Relator of Datalogic - has decided to leave the company to pursue a new professional opportunity in the private equity sector.

The Board of Directors would like to thank Mr. Borgheresi for his activities performed inside Datalogic Group.

The Company has already started the research of the new Group CFO and has appointed Mr. Stefano Biordi as Group CFO ad interim of Datalogic. With the prior approval of the Board of Statutory Auditors, the Board of Directors has also entrusted Mr. Biordi with the role (and responsibilities) of Manager in charge for preparing corporate accounting documents.

Mr. Biordi - certified public accountant and statutory auditor - has over twenty years of experience in the field of statutory audit and tax and corporate consulting, as well as a thorough knowledge of the "corporate" activities, due to the numerous positions, both consultancy and member of the board of statutory auditors, covered during his professional experience with companies and industrial groups.

Mr. Biordi’s Curriculum Vitae is published on the website www.datalogic.com.

Mrs. Vincenza Colucci has been entrusted with the role of Investor Relations. Her Curriculum Vitae is published on the website www.datalogic.com.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

In 2016 revenues growth is expected to be higher than the market average above all in the European and North American Markets where the Group expects a consolidation of its competitive position and a double-digit growth respectively.

Customer satisfaction is at the centre of the value chain of the Datalogic Group; in 2016 attention in satisfying the customer's needs and the advanced technology of the company's products, which are key drivers to reach the Group's growth objectives, will provide a channelled response to the market with a special focus on the range of applications addressing the retail, transport and logistics, the manufacturing industry and health sectors.

The Group will continue to make significant investments in research and development and benefit from an increase in margins which is expected above all through operating cost optimization projects following projects for organizing and centralizing activities and internal organizational functions.

In this situation, both of Datalogic's Divisions are deemed to be in a favourable position to take advantage of market opportunities thanks to considerable investments made in research and development and the sales network and also the "go to market" strategies that are aligned with the reference sectors.

***

At the Shareholders Meeting planned to take place on 2nd May 2016 the Board of Directors will propose to distribute an ordinary unit dividend, gross of legal withholdings, of 25 cents per share (+38.9% compared to 18 cents per share paid for 2014), for a maximum amount of approximately 14.6 million Euro, with coupon detachment on 9 May 2016 (record date 10 May) and payment from 11 May 2016.

The Board of Directors also approved the Annual Corporate Governance Report. A copy of the report will be available to the public in accordance with applicable law.

Note that the auditing of the draft financial statements has not yet been completed and that the independent auditors’ report will be made available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Finally, the Annual Financial Report (pursuant to article 154-ter of the Testo Unico della Finanza - TUF) of Datalogic S.p.A. will be available to anyone who requests it at the company headquarters or at Borsa Italiana SpA, on the “Storage” instrument, managed by BIt Market Services and may also be consulted on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations.

The manager responsible for preparing the company’s financial reports – Sergio Borgheresi – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st December 2015 – Euro/1.000

1EBITDA - Earnings before interest, taxes, depreciation and amortization.

The EBITDA is used by the Management to monitor and assess the operational performance of the Group and is not identified as an accounting item within IFRS. Given that the composition of this measure is not regulated by the reference accounting standards, it is not subject to any audit procedure by the Independent Auditors.

Reclassified Balance Sheet at 31st December ( ) – Euro/1.000

2 The reclassified Balance Sheet shows measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.

Net Financial Position at 31st December 2015 – Euro/1.000

|